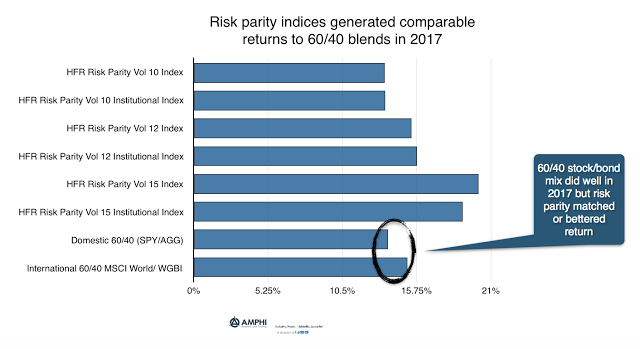

The 60/40 stock/bond blends both domestic and international generated double-digit returns on strong equity performance. The majority of the risk came from the stock allocation which make them sensitive to any market reversal.

Risk parity programs as measured by the HFR index series also provided good returns in 2017 with performance that matched or bettered the more traditional dollar weighted portfolio. This risk parity approach offers an alternative asset allocation weighting scheme in an overall market where equities are overvalued.

We have argued that risk parity has some macro flaws. These programs will be sellers in a risking volatility market which may create negative feedback loops, but the idea of allocating across a broader set of asset classes and employing schemes that move away from asset class dollar weighting have merit. Most global macro and managed futures have risk parity features which ensure asset class diversification.