What has been the biggest change in thinking about global macro investing in the last ten years? Some could say it is the “anything is possible” view toward central banks. There is now nothing like normal central bank behavior. Others could say that it just the change in macro relationships which has made looking at old price relationship suspect.

I would argue that the way global macro managers think about market connections is what is different. The concept of networks has changed thinking about global macro. The “connectedness” of markets and financial institutions is the new narrative that will drive cross-market relationships. In an extreme efficient markets world, the issue of networks is not really relevant, but in a levered world of cross-market lending, collateral management, banking regulation, and global capital flows, the type of relationships across markets matter. Those managers who understand networking effects will be winners and those that do not incorporate network effects will be losers. This will be especially evident if we have a systemic market shock.

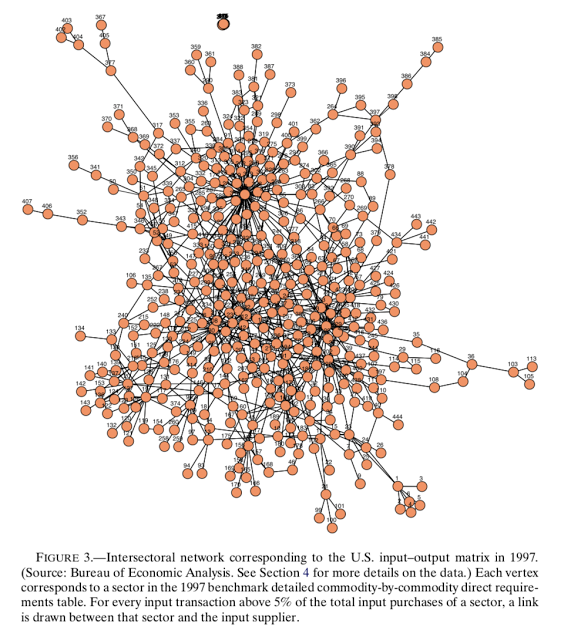

The idea of networking effects is apparent across significant amount of macro/finance research. While most of this work has focused on macro prudential and systemic research, it has impact across all macro thinking. See The Network Origins of Aggregate Fluctuations to get a flavor for this type of research.

The key problem with this new thinking is translating the idea of networks into operational tools for inter-market connectedness and how cross-market spreads will be affected by it. It clearly will have non-linear impacts that will not be picked up by linear correlation, but how it is used is still being worked out.

Some managers have an intuitive idea of how markets are connected, but may not have an operational model. We believe operational models can be developed to help with the process to identify and exploit connectedness that will lead to feedback.

At the least, questions with a networking focus can be asked about cross-market effects.

- Capital requirements and bank regulation – How do regulations lead to cross-market spillovers?

- How do volatility shocks impact market behavior when assets are used a loan collateral?

- How do ETF flows impact price behavior?

- How does capital flow from global banks into EM markets impact currency rates?

Forget linear correlation and think non-linear networks and connectedness.