The relationship between growth and equity market returns is not always direct. Equities can move higher because of an increase in earnings growth or from an increase in valuation. Market earnings should increase with economic activity but they may vary across the cycle. Similarly, the relationship between growth and nominal yields also can be variable albeit generally positive. Higher growth may lead to higher real rates, higher expected inflation or a change in monetary policy. The problem is that actual economic growth often has reporting delays so the link with market prices is mixed. The link between prices and fundamentals should focus on leading or forward-looking indicators.

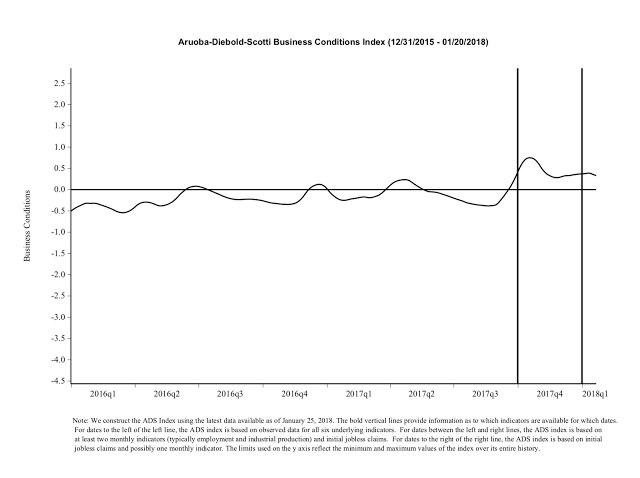

One useful indicator is the Philly Fed ADS Business Conditions Index which blends high and low frequency information as well as stock and flow data. The index clearly exploded on the upside in the third quarter of last year and has continued to stay high even if it is off index highs. These readings are consistent with a strong stock market and a weak bond market. Given it has continued to show positive readings, holding existing stock-bond allocations make sense.

Now, the ADS index has given mixed signal since the Financial Crisis consistent with the slower growth in the real economy, but in a more normalized monetary environment, we expect that this index will provide better signals.