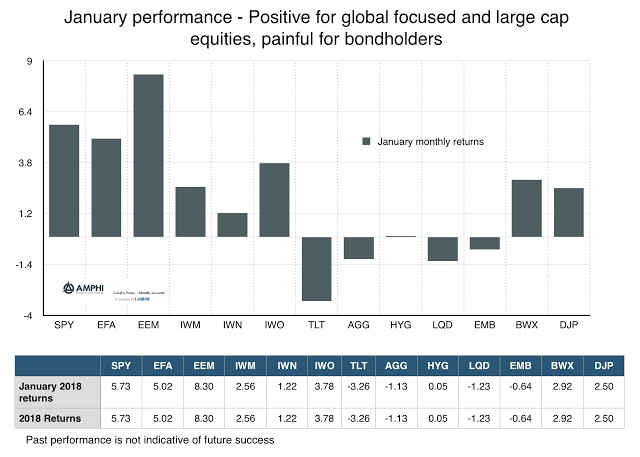

With continued euphoria about global growth and growing fears of inflation, the large cap and international stock investors saw strong gains while bondholders were hit with loses. Markets in January saw extremes in what were identified as the core themes for the year, growth plus inflation. Now, there may be stagflation holdouts, but growth indicators are still strongly positive albeit there are signs that the trends in positive economic surprises last quarter will be more tempered.

A good rule of thumb when faced with economic euphoria is that it will not last. Growth may be strong in 2018, but less than the spikes in real numbers or surges in business and consumer surveys. Inflation will move higher, but more likely at a pace that will asymptotically approach 2% as opposed breaking-out above targets.

Nevertheless, a key concern should be that equity returns are closing in on 2018 year-end median forecasts made just last month. Forecasters can be wrong, especially about market values, but the momentum of the January rise in equities seems to be a concern as evidenced by the market declines in the few days.

Given the view of moderation in economic reality and exuberance in market behavior, a rebalance into diversifying asset will have value. Take some of the dollar excesses of January and place them in an uncorrelated strategy.