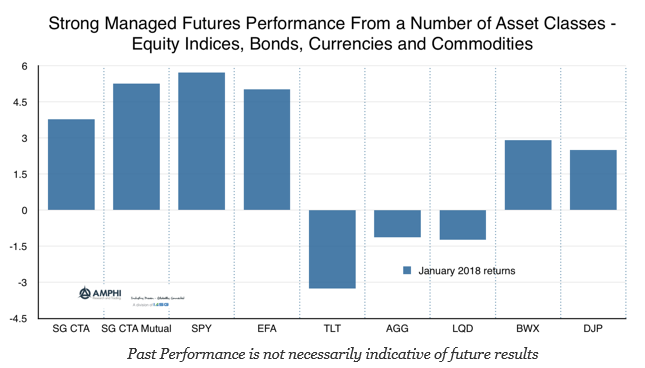

Managed futures showed strong performance in January from a variety of asset classes. Many managers were able to continue to take advantage of the trend in US equities, albeit with a giveback of some profits at the end of the month. Global bonds generated gains from short positions as a significant sell-off accelerated through the month. The dollar decline made trading currencies also profitable. The trend in oil and refined products also continued although a surprise inventory increase at the end of month added volatility. Selective trading in precious and base metals also added to performance. There were also commodity opportunities from newly formed trends.

This was the best month for the SocGen CTA index in the last year and a half. For the CTA mutual fund index, this was the best month since the index began in 2014. The average manager beat all asset classes except for beta plays in equities. These high returns from trends were consistent with the current fundamental themes of high growth and higher expected inflation for 2018.