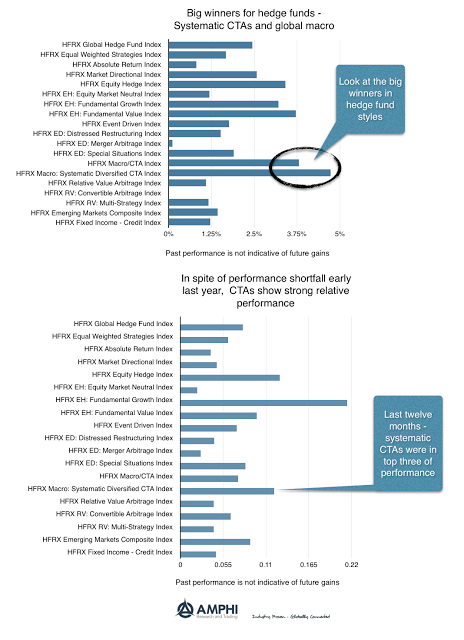

Hedge fund performance, as measured by the HFR indices, showed strong performance in January especially for global macro and systematic CTAs. Systematic CTAs also generated returns that were in the top three categories for the last twelve months.

The reason for these performance gains is not complex. The wide diversity across asset classes allows these strategies to find opportunities beyond equity beta and alpha situations. For the case of January, there have been strong down price trends across the global bond markets. These funds are able to take advantage of these bond moves while the constrained duration relative value equity funds usually stay out of the bond sector. Given the dynamic bond beta bets, managed futures and global macro can profit from asset class dislocations.