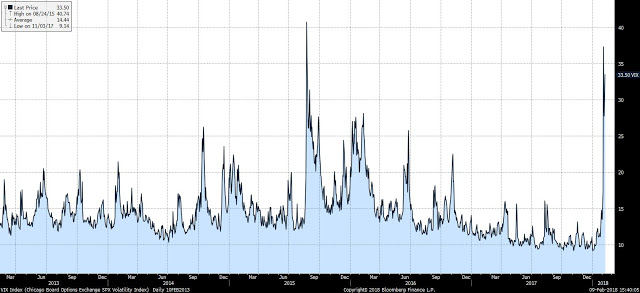

The talk of the markets is the significant spike in the VIX index and the large decline in equities over the same period. An important question is whether the relationship between the stock and volatility has changed with this move. A quick answer is no.

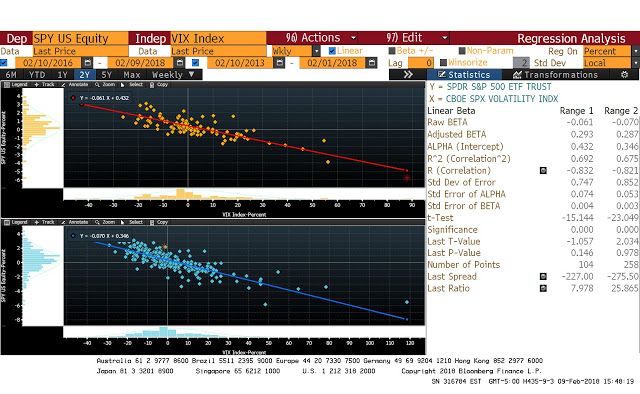

I am not trying to run an exhaustive study, but a simple regression analysis comparing the percentage changes in the market index and the VIX. Regressions can be very sensitive to outliers as well as different sample periods, so I compared a five-year period not including the month of February against the last two years with February data. There is no significant change in the relationship. The markets behaved in a manner consistent with the long-term relationship between stock indices and volatility. More work can be done to analyze this relationship, but as a first pass, this is interesting food for thought.