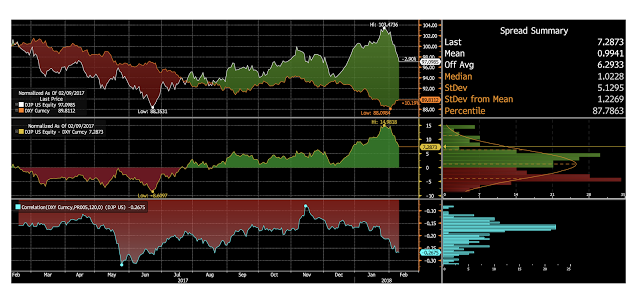

The dollar may be trending down, but investors should also look at the second order effects of what will happen to other markets. For example, a declining dollar is good for long commodity exposure. The long commodity argument is twofold, one, a decline in the dollar makes commodities denominated in dollars cheaper to foreign buyers which will increase demand; two, a decline in the dollar associated with global growth will increase global commodity demand. There are both substitution and income effects.

Now, a dollar decrease will make producer prices for commodities in the US more expensive but the size of the US economy and the demand for raw commodities is falling relative to the rest of the world so this dollar-commodity effect will be stronger as the rest of the world gets larger versus the US.

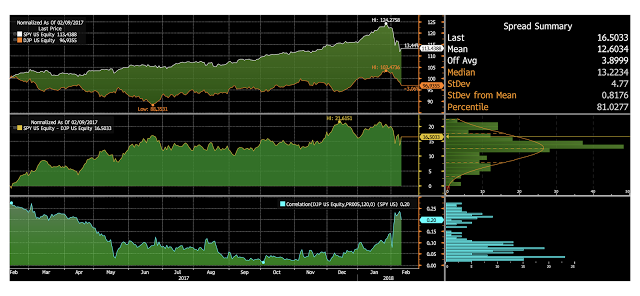

The dollar link will not be the only driver, but for longer-term asset allocation, it a good relationship that can be exploited. Additionally, the correlation between stocks and commodities is low, so investors gain diversification from holding commodities at a time when they are cheap relative to finical assets and there are higher expectations for inflation.