There was a clear financial shock to the market with the spike in the VIX index earlier this month, but the market has reversed a significant portion of the earlier losses. From the SPY high in January, the market declined about 10.5%. There has been a reversal of 6% so the stock market is now positive for the year and only down 4.5% from the high and down 2% from month-end.

At the time of the sell-off, there was significant uncertainty and few were advocating the volatility spike as a buying opportunity, but it is important to try and classify financial shocks to judge their potential impact. We classify financial shocks into two types: exogenous and endogenous.

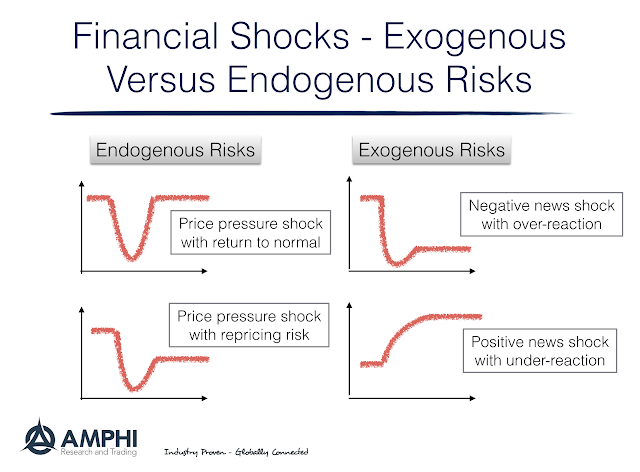

Exogenous shocks will result in asset price responses to outside information like an economic data surprise or Fed announcement. New information may lead to a revision in asset price valuations. Usually, there is evidence that asset markets will over-react to negative news and under-react to positive news. A bad news overreaction is caused by the need for markets to offer lower prices to attract new buyers. There is an under-reaction to good news because existing buyers will hold positions and a higher risk premium is not needed.

Endogenous shocks will cause asset prices to react to some event that is associated with actual price activity. It could be a change in prices from selling or buying pressure independent of an information announcement. An example would be a “flash crash” where order flow changes caused significant selling pressure. Obviously, these events are hard to predict and may be tied with an exogenous event. The endogenous event may be a feedback loop that starts with an information event.

When we look at the February volatility spike and market sell-off, there were some events that commentators have used for cause and effect, but there was no single event or information shock that created the sell-off. Consequently, we are having a reversal of the endogenous shocks. However, there may be a reprising of risk because investors are aware of a volatility shock. This may preclude markets from reaching the old high unless there is new information to suggest that valuations can move higher. Classifying the financial shock may help determine the correct action when the next market event occurs.