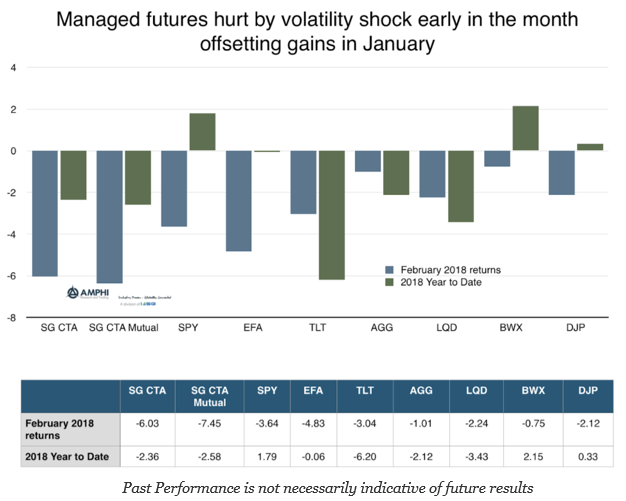

The managed futures hedge fund category generated poor performance in February as measured by the SocGen CTA index and the SocGen CTA mutual fund index. This behavior was also seen in the BTOP 50 index which declined 5.29 percent for the month. The SocGen short-term traders index was down 4.31 for the month but still up for the year by just over 1%. Nevertheless, the year to date return numbers for managed futures are better than long duration bond performance and the credit sector as measured by the TLT and LQD ETFs.

We will have to wait on the other hedge fund sector indices and a full listing of performance, but there was large dispersion in manage futures returns. Shorter-term managers performed better given their faster response to any financial shock. Longer-term trend followers underperformed given the slower response and the likelihood that position changing was not able to capture the equity reversal.

Risk management may have done its job through stops and reversals, but the increase in volatility generated a reduction in position sizes and leverage. Fund leverage was cut and signal to noise ratios were lower which further reduced positioning. Hence, risk exposures coming out of the shock were lower than levels going into the month. This restructuring dampened performance after the shock.

Systematic models that make decisions based on longer-term data will be harmed by financial shocks that generate short-term price spikes. Even models that look through short-term prices movements may react defensively to a shock. Losses cannot be easily reversed after deleveraging. Short-term traders fared better but the size of the move and change in volatility caught many by surprise.

Large losses accumulate when there have been strong trends which usually lead to accumulated profits over time. Price that diverge from longer trends will usually have more risk potential which is the basis for momentum crashes. Traders were also hurt by the increased correlation across many assets.

February was a strong test for system design, portfolio construction, and risk management. Unfortunately, some managers did not pass the test and even good managers could not sidestep this volatility shock.