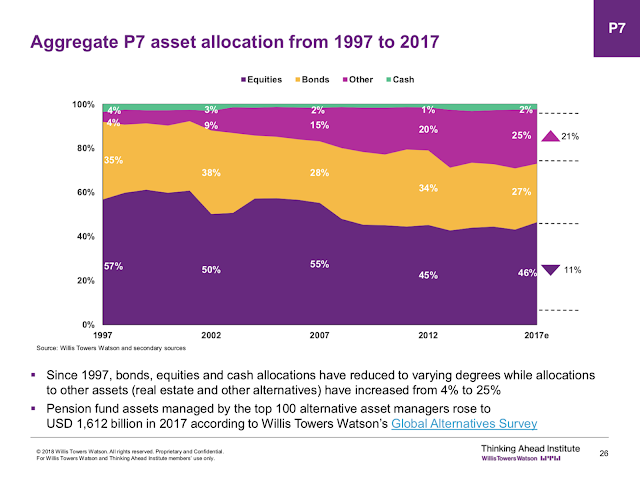

The Willis Towers Watson annual survey provides a wealth of information on global pensions and their asset allocations. Pension asset allocations around the world continue to show a move away from the simple equity and bond betas. The current survey shows only 75% of allocations are between equities, bonds, and cash with equities only given an allocation of less than 50%. These allocation numbers, however, show an increasing exposure to global equities and bonds. The other basket, representing the remaining 25%, includes real state and alternatives which can include a wide range of investment products. Pensions continue to move out of equity and bonds for alpha capital appreciation and income. The US equity allocation is down 10% since 2007 (60% to 50%) while the other category is up 10% from 18% to 28% over the same period.

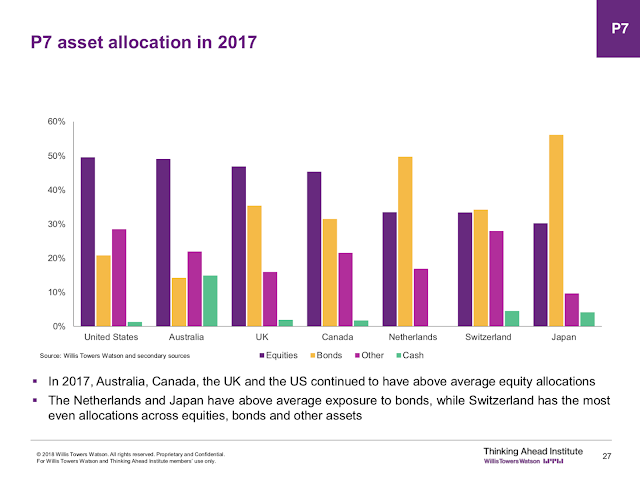

Nevertheless, there are significant differences between countries for allocation. The US has the highest equity allocation of any country while Japan has allocations that are heavily skewed to bonds. Switzerland, on the other hand, has a very balanced allocation across equity, bonds, and alternatives. There is also significant differences between defined benefit and defined contribution allocations with the US divided 60/40 between DC/DB while a country like Canada has a 95% exposure to DB pension plans.

Pension funds have not taken advantage of the equity rally over the last 10 years and have instead moved to real estate and other allocations. Moreover, in the last five years, pensions have switched from bonds to alternatives. These switches suggest that alternatives are being positioned in portfolios differently over the last ten years. For example, in the US, allocations to equities (risk assets) have stabilized and alternatives are now being used as bond substitutes.

Our view is that further increases in alternatives may come at the expense of bonds but pension may be reaching limits to alternative allocations. Additionally, the switch to DC plans will result in further need for alternative ’40 Act and UCIT fund products and wider distribution strategies. Continued pension fund changes will further impact the structural behavior of hedge fund pricing and product offerings.