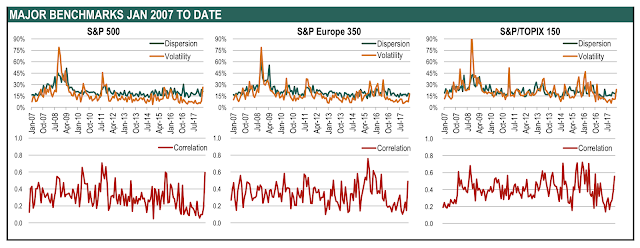

We follow the dispersion, volatility and correlation indices generated by Standard & Poor’s which show intra-index stock behavior over time. When the correlation across stocks within in an index is high, there is a clear sign that the market is facing a macro shock. Performance should be biased toward beta risks. Fund returns will be driven by their beta exposure and timing skill not by their stock-picking skill. When correlation is low across stocks within an index, we can say it is a stock picker’s environment because skill-based traders will be rewarded for exploiting differentiation across firms. This lower correlation will generate more dispersion in returns if there is additional volatility.

Given the volatility shock, February was a beta-timing environment. Those managers with higher beta exposure suffered. Those with lower beta exposure had more muted returns. Those managers who adjusted quickly to the environment or did not get whipsawed showed better performance.

The last year showed a longer period of low correlation which should have been better for stock-pickers, but the low volatility kept return dispersions relatively stable so opportunities were limited or not significantly different from earlier periods of higher volatility tied with higher correlation. The Goldilocks conditions for stock-pickers would be a combination of low correlation with higher volatility. Investors await those conditions.