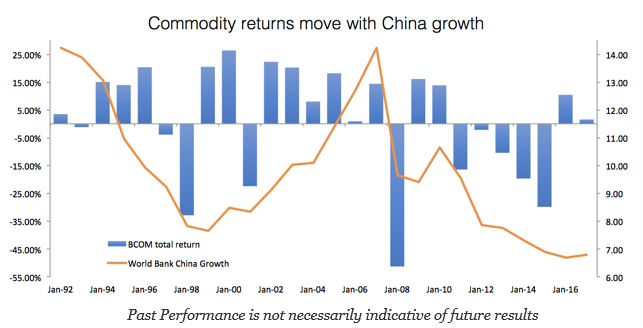

We have previously posted the relationship between global growth and commodity returns as measured by the leading index (BCOM). Global growth above 3% is a good tailwind for overall commodity demand that will push prices higher.

If we drive down one level deeper, we can see the strong link between China growth and commodities. A slowdown in China growth will provide a headwind that will limit any broad increase in commodity prices.

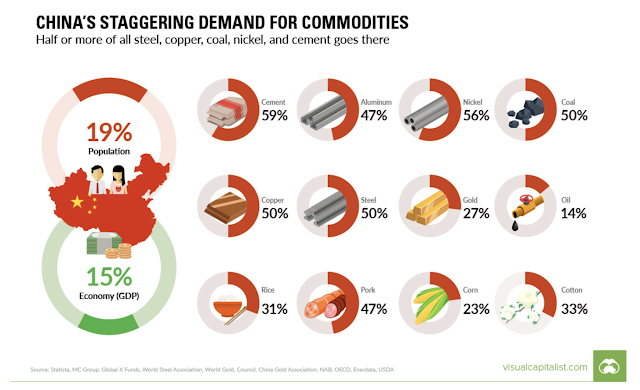

The importance of China to commodity markets cannot be understated since its percentage of global demand for many commodities is so high. This strong demand exists not only for metals but also foodstuffs and is out-sized relative to their global GDP and population. This demand has been strengthened by the huge debt increases that have fueled China growth; consequently, commodity returns are more complex than just a play on inflation.

There are a number of factors that should be considered for any commodity exposure, global including China and EM growth and global inflation. Commodities can be used as an alternative way to gain growth factor exposures without taking the valuation risks currently found in stocks and bonds around the globe.