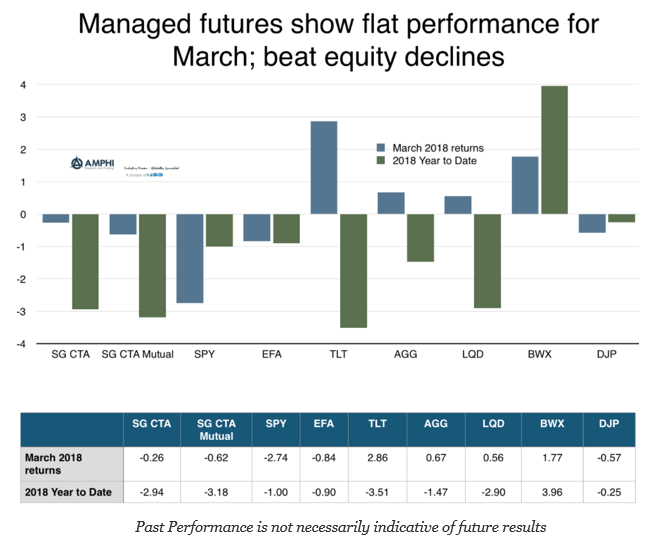

Managed futures index returns were slightly negative for the month with the SocGen CTA index down 26 bps and the SocGen CTA mutual fund index down 62 bps. The BTOP 50 index gained 26 bps for the month. This compared favorably against many equity indices, but was less than the fixed income indices. Trend-following managers were not able to catch the early rotations from equities to bonds during the second half of the month.

The flat performance for managed futures was consistent with the higher volatility environment and relative flat price slopes in many asset classes. Equities rebounded during the first half of the month only to decline once talk of “trade wars” accelerated. Similarly, the bond prices were range-bound until the up trend in the second half of the month. Trend rotation now has short equity and long bond positions for April.