Trend-following CTAs and managed futures has evolved over the years. Many of the largest firms today would not be recognizable from those who were the largest during the 1980s and 90s. Some of this change in leadership is due to business decisions, but it also has to do with the evolution of the investment process. CTAs have evolved with research trends in finance, the changing focus of overall money management, technological developments, and structural changes in markets.

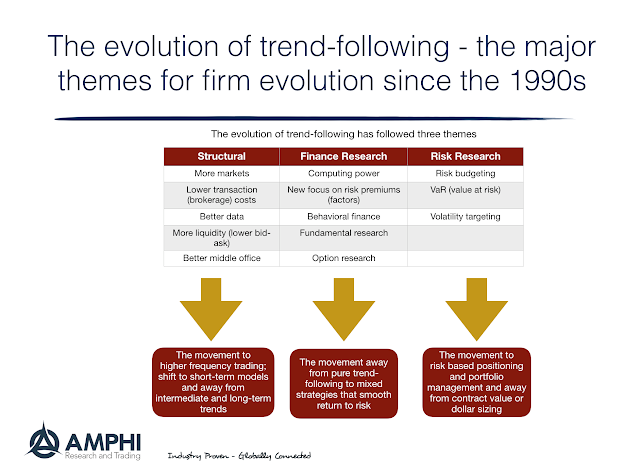

We provide three highly stylized themes that have changed managed futures trend-followers: structural, finance research and risk research. These can serve as a point of departure for further discussion on how firms and strategies evolve.

Managed futures have moved from the focused intermediate to long-term trend-following of the 80s and early 90s to more mixed strategies of more markets traded, more styles employed, and alternative timeframes for trading. These mixing of style, timing, and markets serve as mechanisms for smoothing returns, improving return to risk ratios, and finding ways to maintain fees as simpler quantitative strategies become commoditized.

Trend-following was traditionally focused on finding opportunities within time series with market diversification added in order to offset the mixed quality of the times series signals. Risk management was a core component of programs through the use of stop-loses for each position. Sizing was usually based on a contracts per million basis and not volatility.

With cheaper costs for execution and markets to trade around the world, trend-followers increase the range of timeframes for trading and the set of opportunities. Changes in market structured has allowed for time and market diversification.

Times series work to determine the trends for each market has been coupled with the momentum revolution, so that cross-sectional work of ranking markets is now a core part of trend-following diversification.

Strategy diversification has started to include carry type trades and position adjustment based on risk-on/risk-off indicators. The movement to quant approaches beyond trend opened up program development on two fronts; first, the diversification of programs to take advantage of different risk premiums outside of momentum and second, the development of explicit risk premium programs to have business alternatives to the more concentrated return profile of trend-following.

Given the uncorrelated nature of risk premiums and potential issues of liquidity, it is a natural business extension to develop research in uncorrelated models that will business diversification. As prices with core trend-following have further declined, the speed of on new product development has intensified.

With the development in VaR and advancements in risk thinking, trend-following managers moved from dollar-weighted positions to volatility positioning as a standard. Volatility position-sizing has also been coupled with volatility weighted sectors, and targeted program volatility. All of these techniques are a means of supporting risk management beyond stops to individual positions. The development of risk parity models are consistent this volatility work by CTAs. It could be viewed that risk parity is the no-information, no view portfolio while trend-following is a price-based view.

Firms have now formed a range of program offerings from pure trend-following, to alternative risk premiums, to diversified blends or multi-alternative offerings. The concept of single strategy trend-following firms has been essentially dropped to a more general approach of quantitative asset management employing different strategies.