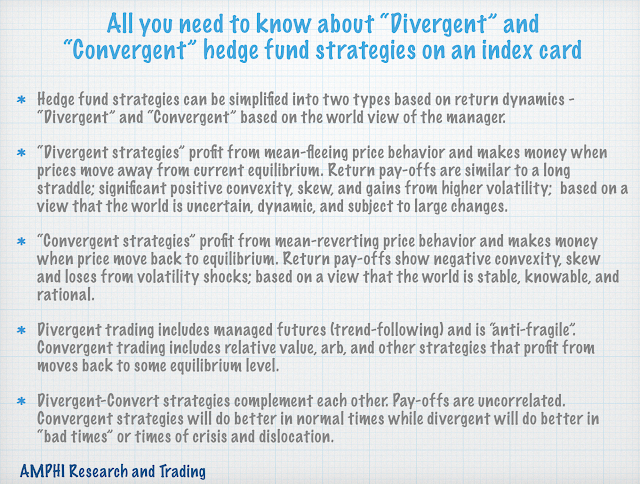

This is the second in our series; all you need to know about a topic should fit on a “3 by 5” index card. We think the complexity of hedge fund investing can be simplified if the simple dichotomy of divergent and convergent trading is used as a primary method of describing potential return pay-offs.

If you strip away all of the activities and the just get down to basics, strategies are based on the world view of the manager and will either make money when prices move away from the mean or equilibrium price or prices revert to the mean or equilibrium price. If a manager believes the world is knowable, stable, and rational, he will be comfortable taking relative value arbitrage risks. If a manager believes the world its unknowable, dynamic, and subject to mistakes and biases, he will be comfortable with strategies that make money from market dislocations.

Investors will be rewarded from convergent trading when prices are stable and times are normal. You will be rewarded with holding divergent strategies when there are large market dislocation and price movement away from the mean. This is not the end of the story on hedge fund investing but a good start for any discussion.