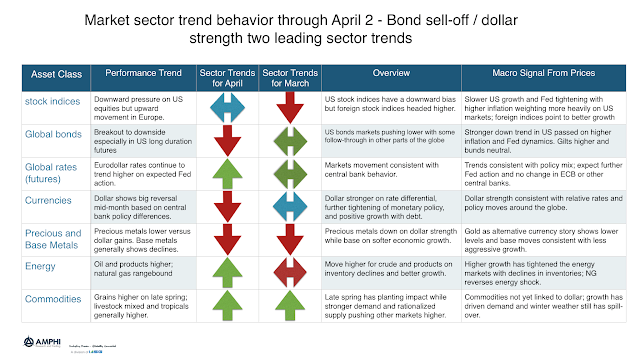

Our sector trend indicators, a combination of different trend length directions added across markets within a sector, show some significant changes from last month. This represents opportunities for May but also why some managers showed mixed performance for April.

The two biggest sector changes are with bonds that moved to strong down trends in the US and currencies which fell almost across the board versus the dollar. Dollar strengthening on further rate increases and the continued signals of Fed tightening was a major reversal from earlier in the year. Fears of inflation have taken hold of US bond investors but not with the same anxiousness in other global debt markets. Stock indices were mixed with US equities pointed down slightly and foreign stock indices moving higher.

Precious and base metals moved lower. Gold moved lower on the dollar strength. Energy prices were higher on further inventory adjustment and commodities were affected by the late spring.

Bonds and the dollar generated strong breakouts which offered opportunities for short-term traders, but we have seen steep trends often reverse. Nevertheless, sector indices suggest good opportunities for trend-followers in May.

Past Performance is not necessarily indicative of future results.