There could be a desire to look for special patterns within April performance, but the only clear theme is the risk associated with holding bonds during a rising inflation expectation and tightening Fed environment. These issues spill-over to the dollar which affected affects the performance of international stocks.

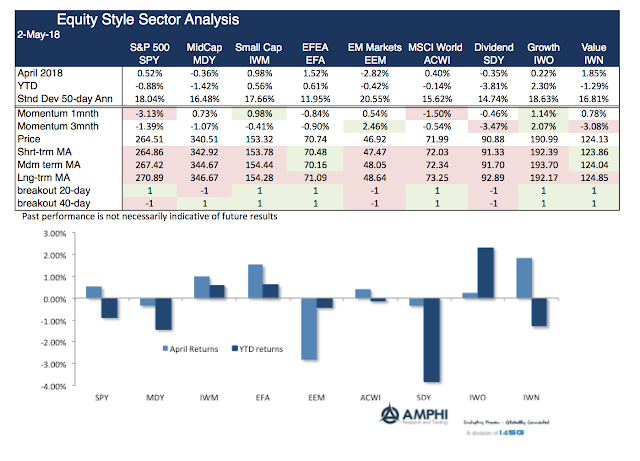

Emerging markets faced a difficult month after looking like it was the equity sector of most promise earlier in the year. Growth is still expected to be higher in EM; however, it generally the case that EM will be higher and more volatile than developed countries.

The strongest sectors for the year have been global equities (EFA) and growth (IWO). Growth has been driven technology and strong earnings that have exceeded analyst estimates for the first quarter.

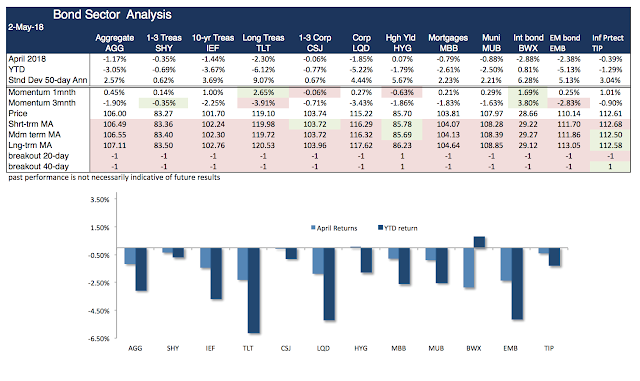

April was a difficult month for most fixed income sectors with high yield being the only one that produced a positive monthly return. All fixed income sectors are down for the year with the exception of international bonds which got a tailwind from the weaker dollar, but even that support has changed in April. While the rationale for the sell-off has been focused on inflation, TIPS have also generated a negative return year to date.

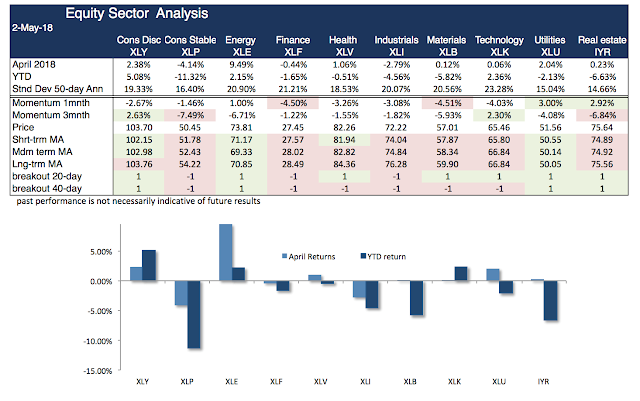

The equity sectors showed double-digit differences with energy almost up 9.5% and consumer stables declining over 4%. The only winning sectors for the year are technology and energy.

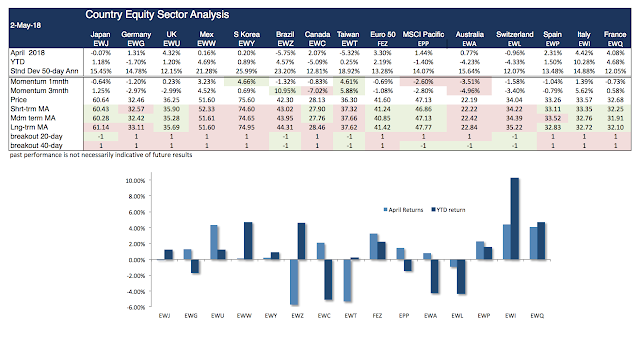

Country specific returns showed the greatest gains in core Europe while Asia and Latin America country indices lagged behind. For the year, the two weakest country returns were with Canada and Australia, heavy commodity exporters. The biggest winners have been Italy, France, Brazil and Mexico. Perhaps these are large reversals from poorer performance last year. France is going through labor reforms. Brazil has faced political issues and Mexico has seen trade volatility.

While we like to look at themes across these sectors, the most important take-away is that diversification matters. A core portfolio diversified across styles and sectors is the safest way to build a portfolio if there is no clear market view. Tilts within this core will be related specific views when the investor has an information advantage. By definition, these times of information advantage should be infrequent.

Past performance is not necessarily indicative of future results