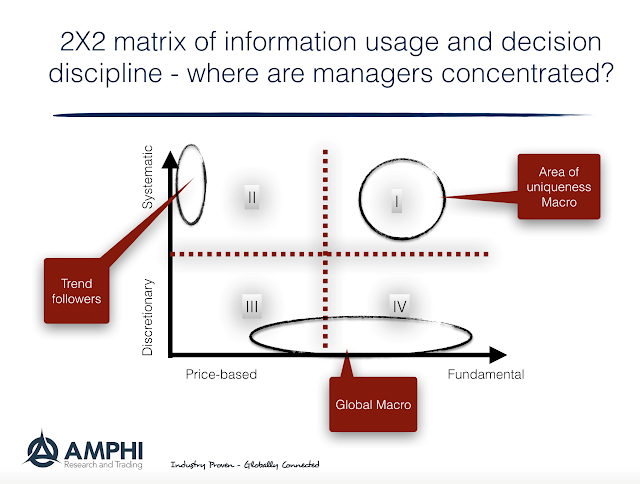

How do you classify global macro firms? There are a wide variety of hedge funds that call themselves global macro so a classification scheme may help distinguish possible return patterns.

One simple method is through the type of information used and the decision-making process employed. Information usage can be either restrictive or broad-based. A restrictive information usage framework could be limited to only price data. This is the focus of trend-followers or those that look at cross-asset spread relationship. A broader-based set would use fundamental information from a wide variety of sources. This could include monetary and real economic data.

The other dimension for global macro classification is through how decisions are made given the information provided. Decisions could either be systematic or discretionary. Both may be disciplined and have rules, but the systematic approach will have a direct mapping from data to action while the discretionary approach may be more situational or flexible on all possible actions.

If this 2×2 framework is employed, it is easy to see where there is concentrated global macro behavior. Quadrant II will be where most trend-followers spend their time. The classic global macro managers will either be in Quadrant III and IV. These managers will differ on the amount of information employed. What is missing are global macro managers which fall into quadrant I. In this quadrant there is wide use of information, both price and fundamental, and systematic decision-making. This approach should have a smoother return profile relative to trend-followers and may react differently than discretionary global macro managers. You will not find many of these global macro managers.

This is not the only way to think about classifying or separating the difference in global macro managers, but it provides a simple approach on two useful factors. By this classification measure, global macro investors should keep a lookout for quadrant I managers.