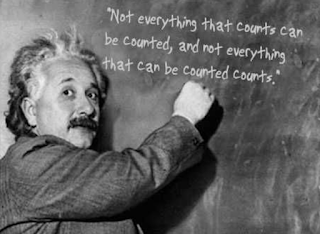

“Not everything that can be counted counts, and not everything that counts can be counted.”

– Credited to William Bruce Cameron instead of Albert Einstein from Cameron’s 1963 text “Informal Sociology: A Casual Introduction to Sociological Thinking” although it was supposedly written on a blackboard by Einstein.

Knowing what to count is an important skill for any quant manager. You will never be able to count everything, and everything that has or can be counted my not be useful. One objective of statistics is to engage in data reduction so you will not be overloaded with counted stuff. Too much counting and there is no ability to understand what is relevant. More importantly, in a complex dynamic investment world, counting may not be enough nor will it always lead to the best answer. (See Living in a VUCA world – This is the core problem for investors.)

There are event that can be imaged and can occur but cannot be counted. First, there are events that have not yet occurred. Second, there are events that do not occur often enough to create a meaning full count. For some this is the need for imagination. For others we call this the need for narrative. Others can call upon scenario analysis to address this shortage of counts.

The fact that there is a need for non-countable thinking means there is a role for narrative and story-telling. This is the place where the science of finance ends and the art of investment begins. Nonetheless, this grey area between quantitative analysis and narrative is an uncomfortable area for investment analysis. A pure quant strategy leaves itself open to problem of dynamic behavior and swings in sentiment. Leaning to far into the area of narration creates an investment process that is not repeatable or measurable.

Wisdom in investment management comes from the experience of knowing what to count and is countable against knowing what should not be counted and should be subjective measured against theory or specific events. The storytelling and narrative is on the surface easy, but hard to do well. Most like to hear and tell story although the action within the narrative is often ambiguous. For most investors following the count is better albeit harder to implement. It forces rules and measurement for dealing with a risky environment. A perfect process will blend counting with narrative.

Give me some metrics! Beware of those metrics

Is investment management a science – Use the “narrativeness” test

Narrative and numbers – You need both for effective forecasting

Narrative economics – Food for thought for quants

Keeping it simple with explanations – An investment narrative needs to answer key questions