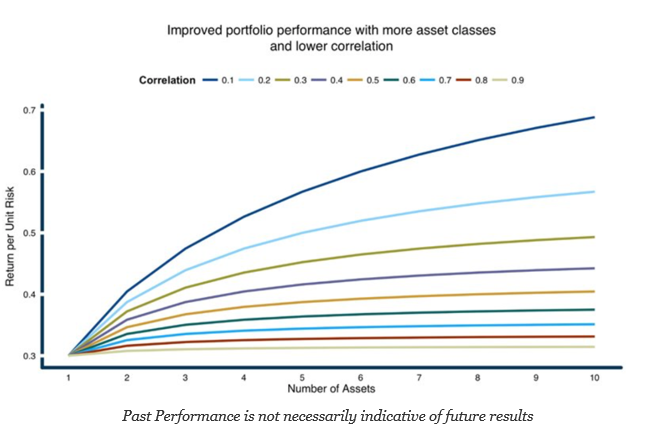

Global diversified, multi-strategy, multi-asset class, portfolio of alt risk premiums, portfolios of traders – it does not matter what is the combination – Get more diversification and you will be a winner. When someone says “diversification is the only free lunch in finance”, the phrase may not truly resonate as well as a picture, and the picture above says it all. I can honestly say that for all of the educating in investments, this picture is not used enough.

Start with a simple return to risk of .3 for one asset and start adding asset classes that have the same return to unit of risk but different correlations. The power of diversification is explosive when correlations are low. There is nothing to get excited about if there is high correlation across assets classes, but it should cause any investors or portfolio manager to jump out of his chair if he starts adding in low correlation assets. You can literally double your information ratio if you can added those low correlation (.1) asset classes.

Of course, the picture represents ideal conditions. There is some bad news with this free lunch. It is hard to find. You will not find many low correlated asset classes and those return to risk values can be volatile. The incremental improvement is strong with the first few diversifiers but there are diminishing returns after that initial boost.

In a practical sense, the first asset class you add to an equity portfolio will be bonds. It has been the great diversify for the last decade or two, but once you get beyond bonds and commodities, the ability to find those low correlation assets becomes much harder. This is the true value of alternative strategies.

One of the great portfolio advantages with adding hedge fund strategies and alternative risk premiums is that these strategies will have lower correlation against core equity and bond indices and thus will provide strong improvement in information ratios. Hedge fund strategies allow for more “free lunch”.

What does this chart mean in reverse? If there is an increase in correlation across asset classes, the return to risk will fall even if the return to risk of any given strategy stays constant. This is will be the incredible shrinking free lunch and is why it is so important to find strategies or investments that have stable correlation relative to traditional asset classes.

Return is critical but hard to forecast. Volatility is important and leads to downside risks. Unfortunately, many forget the power of covariance and its impact on diversification, yet this is component to portfolio construction that can have a strong impact.