One way to measure market uncertainty is to run a simple thought experiment. A well-behaved market should match performance with events in a well-defined manner. An uncertain, complex market environment would behave in an ill-defined manner. Close your eyes and assume you know the news highlights for May. For example:

- Political turmoil in Italy and the EU

- Off-again/on-again North Korea talks

- Good economic data albeit with lower momentum

- EM problems in Turkey and Argentina

- Trade war discussions

What would you expect?

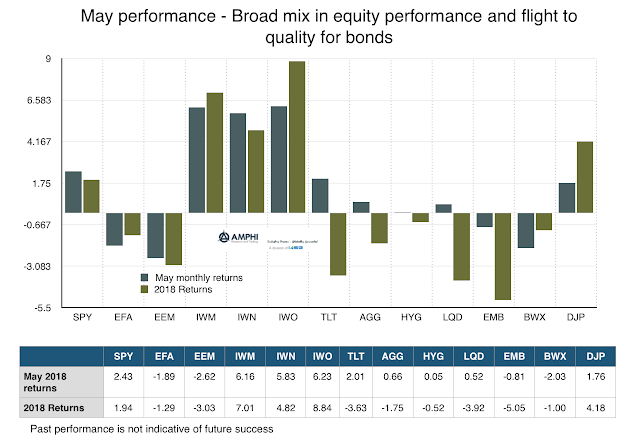

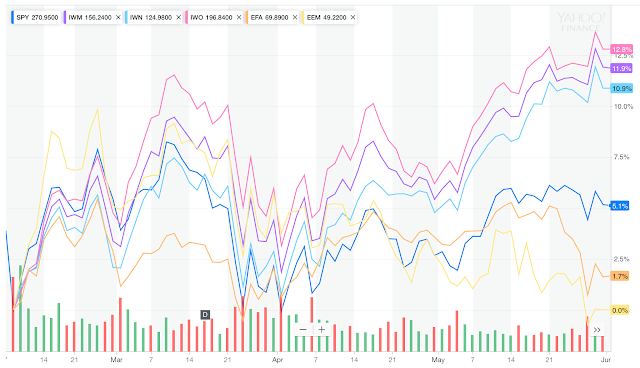

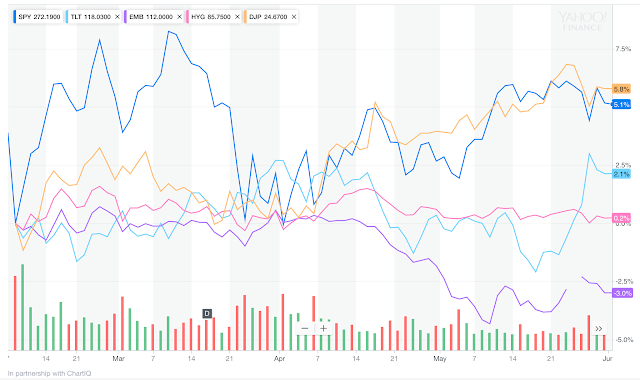

The results for May were quite different from what many would expect for some asset classes. A flight to quality and a Treasury rally seems consistent with the news. Similarly, a decline in developed equity and emerging markets also seem consistent. However, the strong showing with small-cap, value, and growth are out of character in the current environment.

Small cap, growth, and value indices all had gains of over 5 percent for the month, even with higher volatility in the last week. Core domestic equities did better than global, emerging, and large-cap stocks. These numbers are inconsistent with a flight to quality or risk-off behavior by some international investors. Unfortunately, the critical drivers for May are political headline risks which are difficult to handicap. There is little evidence that can be used to provide a likelihood for further momentum or mean reversion.