May saw a set of return reversals with bonds posting gains on flight to quality while international markets saw strong return declines. Selected country equity declines were very strong based on increased political risks. It was a good month for those cautious and focused on US smaller cap names.

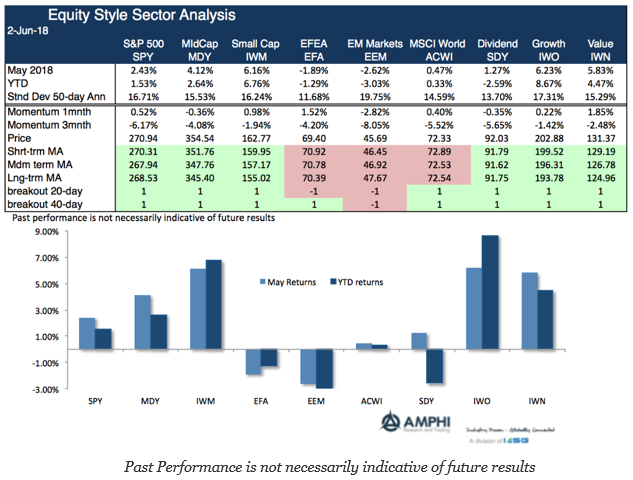

The style gainers for the month were in US centric names, small cap, growth and value. International and emerging market performance declined on dollar strength and capital flight away from political risks focused in specific EU and Latin American countries.

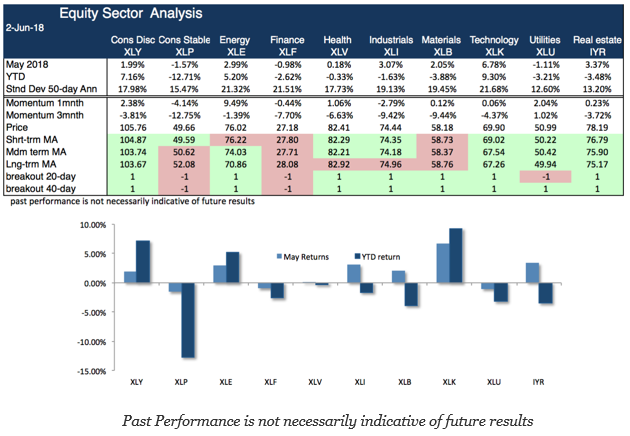

The finance sector declined with the higher rate uncertainty. Rate sensitive sectors like utilities and real estate continue to lag other market sectors. Consumer stables declined again with double digit loses for the year. Technology continues to be the strong sector winner for the year.

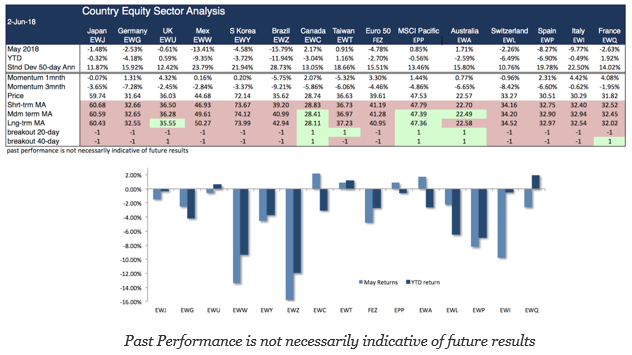

Selected country ETFs were strong losers with double digit loses in Mexico and Brazil. Mexico is facing an important presidential election which may significantly change the business climate regardless of any trade issues with the US. Brazil has been facing strikes that have crippled the economy. Strong declines were posted in Spain and Italy. Italy is facing the problems of forming a coalition government while Spain has dropped on Italy contagion given the poor macroeconomic position of the country.

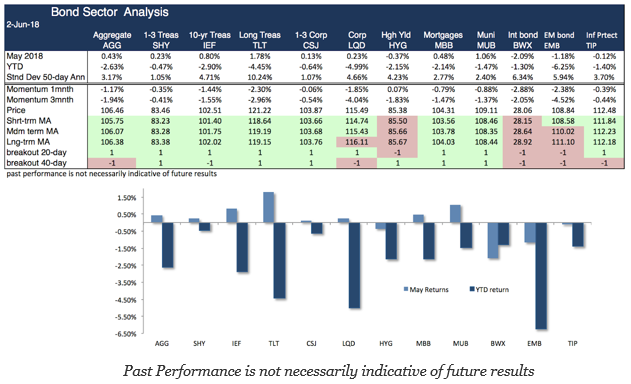

Bonds saw a strong reversal from the flight to quality associated with the Italian problem; however, a strong employment report reversed some of this positive bond euphoria. Sector loses were concentrated in the international and emerging market bonds. Bonds are still negative for the year across sectors.

Our moving average and break-out models point to a few key trends. First, hold US stocks and avoid international sectors. Second, avoid international and emerging market bonds. Third, avoid poor performing countries that are facing political uncertainty. Fourth, maintain or increase real estate, technology and consumer durable sectors. In general, while volatility has fallen since the February shock, there is still significant uncertainty that should mitigate excessive risk-taking.