I have always thought that the simple physics analogy that a market at rest will stay at rest and a market in motion will remain in motion is apt for trend-following. Trends will change when there is a shock or catalyst that will change the underlying fundamentals. Trend-following does not require knowing all of the reasons for why a trend is happening or why it may stop. Trend-following only requires that a signal is extracted and followed until price dynamics tell you otherwise. The success with trend-following is driven by the fact that trends last longer than expected. They last longer because most new information is trend-reinforcing. Fundamentals do not generally change quickly. Nevertheless, losses will occur when further information causes an expectations reversal. Expectations may change more frequently than fundamentals.

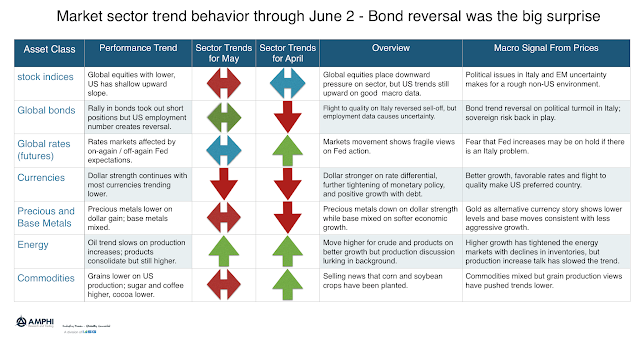

Bond markets faced a significant reversal from their rising rate trend when markets switched to risk-off over the forming of the new government in Italy. EU exit risk is back. This causes revisions in equity, bond, and rate trends. The shocks were strong, but it is not clear whether this change in sentiment will be reinforced by additional new information. Political risk is hard to handicap and even harder to exploit as a trend-follower.

While we have seen trends change in several sectors, currencies, and energy sectors, have continued to follow existing market price action. Our view of sector trend behavior is that June will offer good return opportunities, albeit the size of the gains may be muted.