The four biggest hedge fund launches of 2018 have attracted more than $17bn, according to figures compiled by the FT. That compares with the $13.7bn investors have put in existing funds, according to data from eVestment. from FT Hedge fund stars rake in billions for new funds

Many may know the 80/20 rule-of-thumb for economics, the Pareto Principle. In businesses, 80% of the profits are generated from 20% of the customers. The power law is everywhere and the hedge fund industry is no different. A few firms hold the majority of money. The performance of managers is often positively skewed because poor performer close. Most firms fail.

Most new money goes to a few firms, as is the case in 2018. Behaviorally, investors want to be with smart money which is naturally supposed to be with new big start-ups. Money flows create a herding effect, which perpetuate the power law.

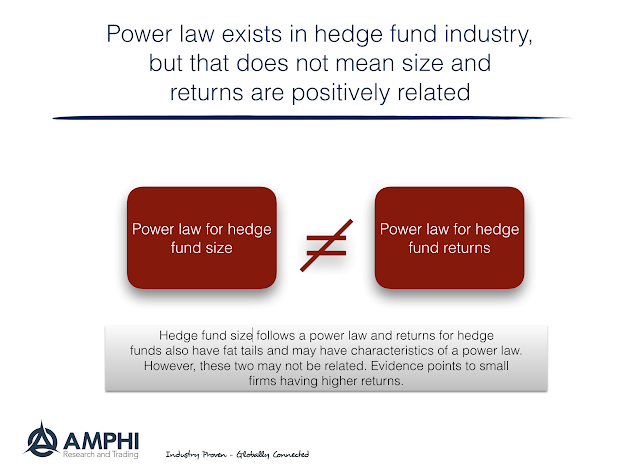

However, data on performance suggest that small firms do better than large firms. The power law with size or launches may not match the fat tails or power law in performance. This shows the complexity or non-linearity within the hedge fund industry. Following the flow or size crowd will not lead to riches in return. A power law in one dimension, size, does not strongly correlated with another dimension return.

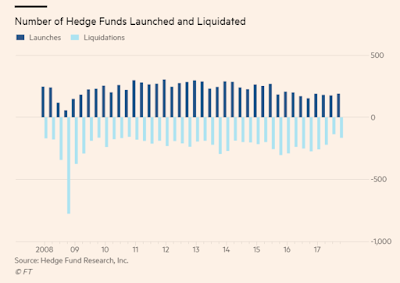

Nevertheless, the dynamic nature of the hedge fund industry means there are constant launches and liquidations so that picking hedge funds is like venture capital investing. A few winners are offset by a larger number of losers. A key process for due diligence and investing is finding the potential size/return trade-off maximum. Using managers that are too small, while potentially generating higher returns, may increase the exposure to firm failure. Using managers that are too large may reduce firm risk but may place a drag on performance. The power law in size may not signal quality.