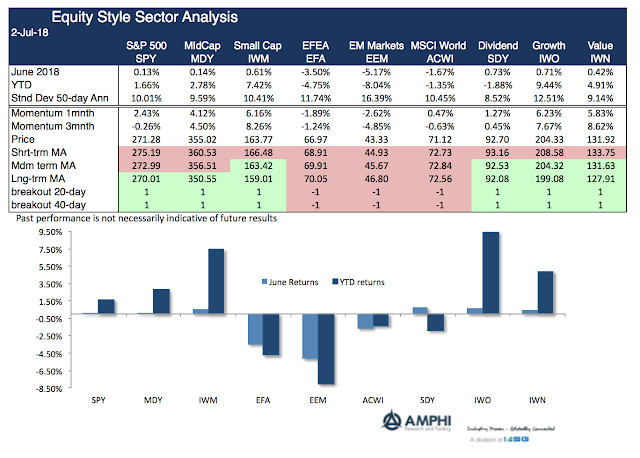

There is a large disconnect between US equities and global equities. The US equity markets seem out of touch with the financial difficulties seen in other parts of the globe, albeit recent price action suggests downside risks increasing. The gap between the small cap and emerging market indices is now above 15% for the first half of the year. Still, there are signs that the disconnect will not last as most styles have fallen below short-term (20-day) moving averages.

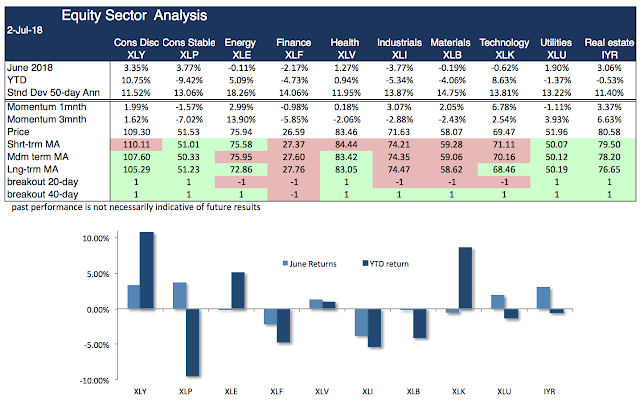

Equity sector differences showed a range of approximately 7% with real estate and consumer staples improving albeit still negative for the year. The sector losers included industrials and finance. While broad-based indices are positive for the first half of the year, the gains have been concentrated in technology and consumer discretionary sectors.

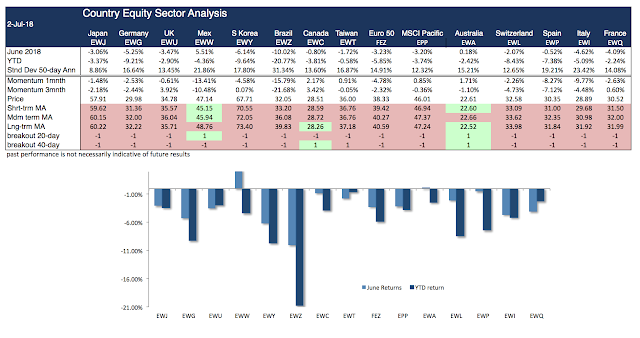

Country indices reflected the global equity sell-off; however, there was one exception, Mexico. With the presidential election showing the winds of change, this may seem surprising. The business community has never been supportive of ALMO, but their fears may not be realized. A reformist could actually invigorate the Mexican economy.

The rest of the country indices tell a simple negative story – further declines in the short, intermediate, and long-run. Although growth expectations were raised for global economies, lower liquidity conditions and trade war rhetoric seems to be dominating financial asset expectations.

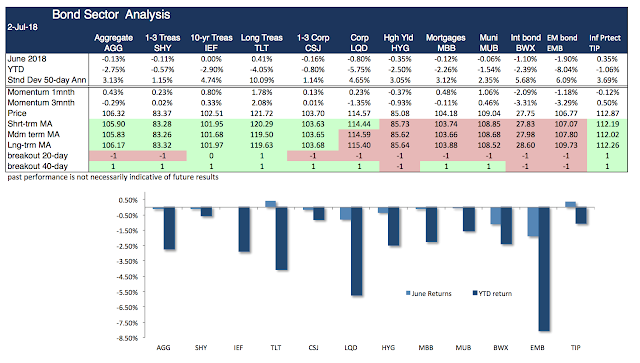

The bond markets are signaling three narratives, poor performance for international debt instruments based on a rising dollar, a tightening of liquidity spilling over to credit markets, and an international flight to safety for Treasuries. We have been surprised by the good Treasury performance for the month given the rising inflation, but the first half of the year shows an asset class the has not provided much yield protection. All indices we track are negative.

The moving average and break-out models we follow over different time horizons suggest avoidance of country risks as well as international stocks and bonds, care with any further risk-taking in the US, and avoidance of yield generating sectors. This is not a good risk-taking environment.