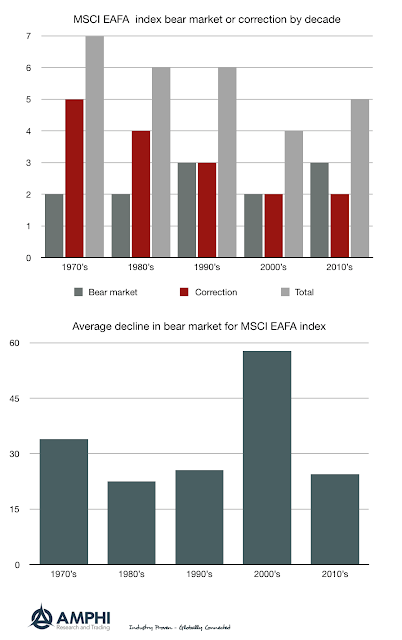

How often should you expect equity bear markets? Using the global diversified MSCI EAFA index, we calculated the number of bear markets, moves down greater than 20%, and corrections, move down greater than 10%, since 1970 by decade. (Hat tip to Ben Carlson of “A wealth of Common Sense” for providing the raw data for developing these charts.) The numbers suggest that you will get 2-3 bear markets per decade. The number of corrections or bear markets total 4 to 7. The average decline of the bear markets is variable. The 2000s decade was horrible with two bear markets more than 50%.

Bear markets will occur. This is why there is an equity risk premium. We already have had three EAFA bears this decade even with all of the liquidity help from central banks and the recorded low volatility.

The answer to these bear markets is simple, diversify; nevertheless, a global diversification strategy for equities will not be enough. There needs to be smart diversification that looks across many asset classes or risk factors. For example momentum/trend-based hedge funds have the significant advantage of going both long and short based on price direction. With this strategy, bear markets can be turned into an opportunity instead of a cost. Strategy diversification does help.

We are currently in an EAFA correction, so the portfolio protection solution is all the more important. Hold broad exposures across asset classes and strategies.