Correlation is not causality. Blending two variables on the same graph does not make a relationship, but there is a core link with the relationship between real and financial assets. Financial assets are related to the future ability of issuers to generate cash flows for dividends or for paying down debt. Growth in real assets are linked to the demand for resources to sustain current and future consumption.

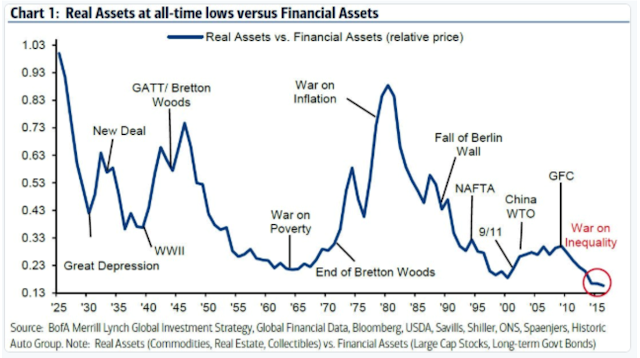

Financial assets are at all time highs versus what is considered real assets; commodities, real estates and collectibles. Real assets usually exploded in relative value during periods of inflation and war when more resources are needed or when commodities are scarce relative to money. The flow of money has moved to financial assets especially those that are related to technologies that do not need capital. The flow of excess money to financial assets and their expected future cash flows exceed demand for real assets that do not immediately generate return but have to be transformed for consumption or usage.

This imbalance is unlikely to continue unless we place continued value on services and intangibles that do not need real assets. We are not suggesting that the ratio should flip but any sense of scarcity for real assets or lower demand for assets with the promised of future gains should increase the relative price.

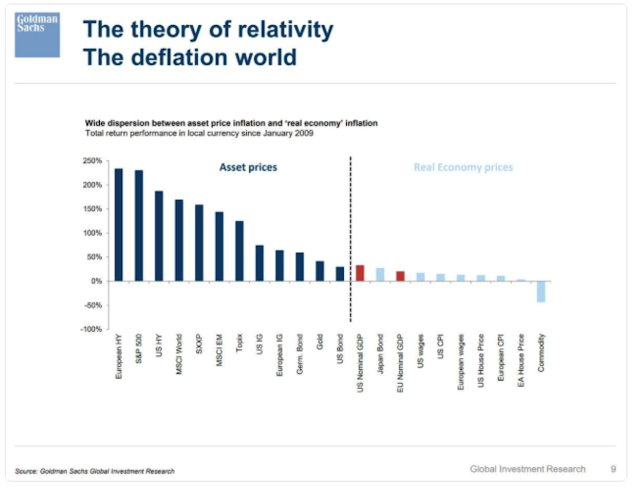

Another way to see this is through comparing asset price inflation and real economy inflation. Real prices have not moved and in the case of commodities have fallen. Financial assets have exploded. The capital gains, dividends, or carry has favored these assets over investing in the real economy. Excess cash has used financial assets as a store of value. This is the collateral used for a levered economy.

This does not mean that investors should place a big trade in commodities, real estate, or companies more closely aligned with the real economy. However, the strategic allocations to real assets that have been under-represented by many pension funds should be topped off. This change in allocation will allow investors to exploit any long-term mean-reversion between financial and real assets.