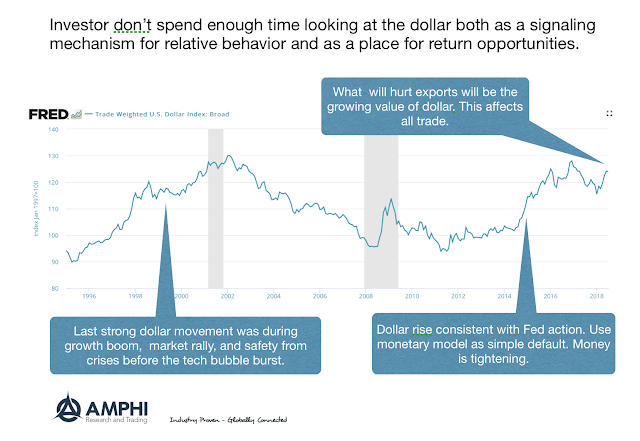

I am concerned about tariffs. They are strong effects on importers and exporters in industries affected by tariffs and we don’t really know how tariffs will impact the supply chain and logistics for many companies. Nevertheless, the strong dollar will have a bigger impact on US exporters across the board.

A strong dollar has global financial disruptions through the change in capital flows hat come with these gains. Last year saw a dollar sell-off and we in a longer-term range, but since the start of the Fed’s end to QE and the raising rates, the direction in the dollar has been up. Look at some quick reasons for dollar gains:

- Stronger asset prices.

- Higher relative rates.

- Tightening of money relative to EMU and Japan

- Higher economic growth and deficits.

- Structural reasons for return of capital to US.

- Dollar hedging.

The dollar is signaling what is happening around global markets. It may have been awhile, but more investors should get into the habit of following currencies.