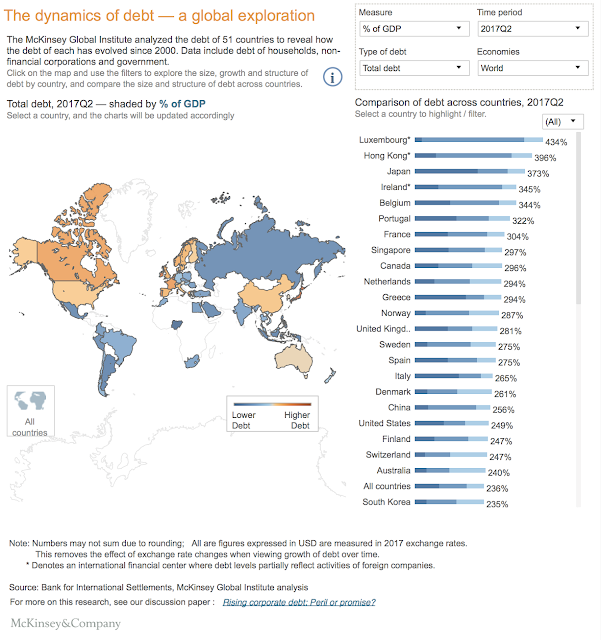

The McKinsey Global Institute published a new report, Rising Corporate Debt: Peril or Promise? that is good reading for anyone focused on global debt issues. The charts and tables provide a wealth of data.

Concerning current debt growth, I always think of the quote from the economist Herb Stein, “If something cannot go on forever, it will stop.” The investment question is determining when the music will stop for debt growth and what will be the spillover effects on financial markets. The impact will be negative. It is just not clear how bad it will be.

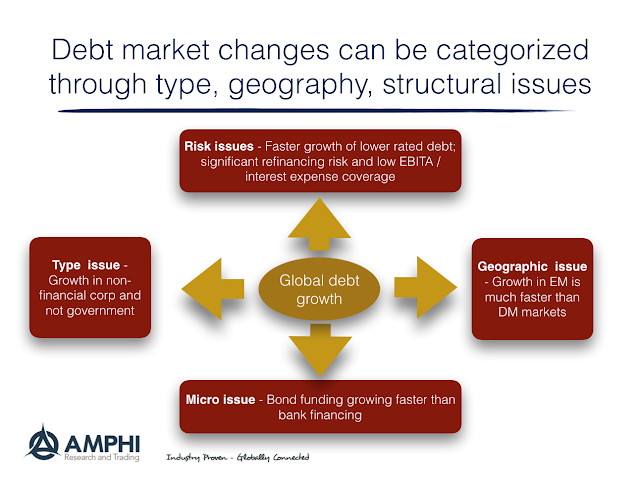

The McKinsey thought piece focuses on four significant areas of change in global debt markets over the last decade beyond its sizable growth.

- Geography – The growth of EM debt has out stripped the growth in DM markets even after accounting for the explosive growth in China. Much of this debt is dollar-denominated.

- Type – The growth in debt by non-financial corporation have outstripped the debt financing by governments. Corporation found an opportunity to obtain cheap money and they took it all over the world.

- Structure – Non-financial corporations jettisoned financing from banks to tap bond markets. With less stringent bond covenants, they have exploited the more anonymous debt markets.

- Risks – Lowered rated corporations (BBB) were the main users of debt markets at the tighter spread levels. However, there is going to be a flood of refinancing over the next few years which will have to be financed at higher rates. The EBITDA coverage of interest payments is relatively low, 1.5 or lower, so higher rates will impact the ability of firms to repay.

The combination of type, geography, structure, and risks makes for a volatile market environment if the positive debt environment is reversed.