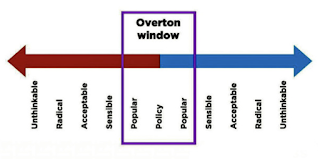

The Overton Window is called the window of discourse for any range of ideas. It has mostly been used to describe differences in political discussions. Extreme views will be unacceptable, but as they are either adjusted or gain traction, there is a window of acceptance or common ground between extremes. The viability of any idea is determined by whether it falls into the window between extremes. Any idea is constrained if it falls out side the window.

The Overton Window can be used to describe the development of ideas in finance. For example, market efficiency or inefficiency could have been viewed as extremes along a spectrum, but now there is an acceptance of a middle ground. Market efficiency was at first unthinkable or thought of as radical in the early 1960’s only to become the acceptable wisdom of the 70’s and 80’s. During the height of the efficiency market paradigm, ideas of behavioral bias were considered radical and not sensible. They were outside the Overton Window of what was popular and hence not employed by investment managers.

The extremes are not accepted but there can a middle ground for market efficiency. Investors now usually accept that there are market inefficiencies but they are hard to find and not easy to exploit.

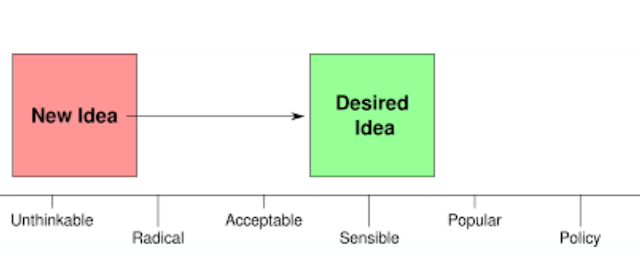

A new idea may move from unthinkable to radical and then onto sensible over time. The idea that behavioral finance could be useful or supplant market efficiency was viewed as something unthinkable in the early 80’s. Then it was viewed as a radical approach by some research extremists. It then became acceptable and sensible. We can now say that it falls between sensible and popular. The process of any ideas acceptance takes time and requires advocates that will be outside the Overton Window to face ridicule while the idea gains traction.

Another simple idea where there has been a movement of the Overton Window is momentum risk premium. A trend follower in the ’80 and ’90s, was considered to be out in the financial wilderness. Trend followers were like barbarians at the edge of financial theory civilization – they engaged in unacceptable behavior and needed to be kept at arms length. Now, momentum is viewed as one of the core risk premiums available to investors. Trend followers have moved from being outsiders to core exploiters of a fundamental risk premium. With a change in attitudes about core financial concepts, trend followers clean up nicely.

Given that the acceptance of ideas change through time as new evidence is presented, we should be less skeptical of new ideas and more skeptical of conventional views. New is not always better, but new should not be feared. Complacency with idea generation should be feared.