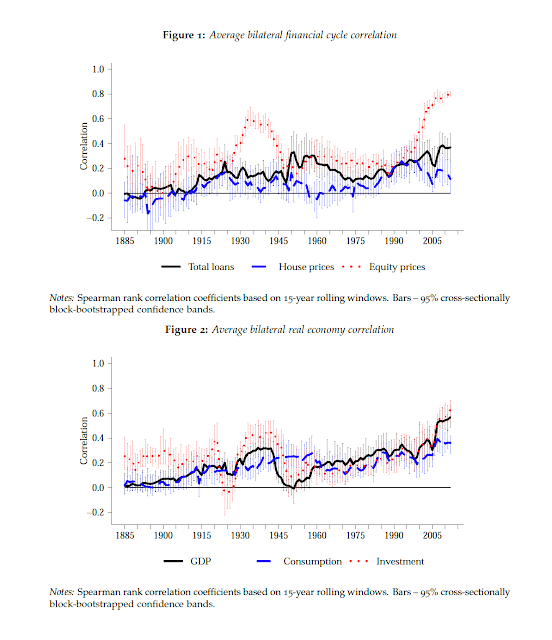

One of the core strategies for portfolio diversification is increasing exposure to international stocks and bonds. This risk reduction strategy is easy to achieve, yet the value of this asset class diversification has diminished over the last few years. The financial cycle has more commonality as measured through times series analysis, and it is harder to achieve the diversification benefits desired if there are more correlated financial cycles.

There are many reasons for this increase in the correlation between financial cycles, but no one explanation can fully explain it, even after accounting for the financial crisis.

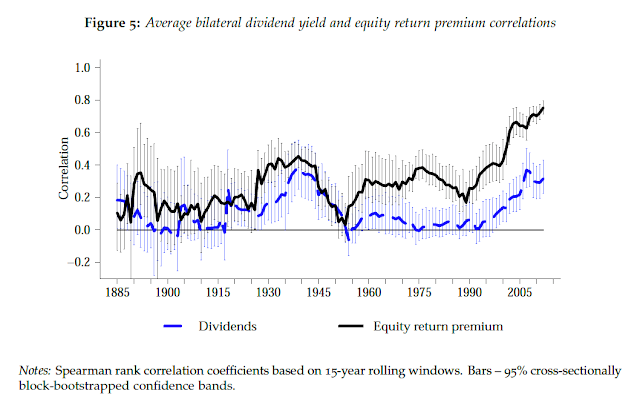

There is a fundamental economic reason for the higher financial correlation; bilateral GDPs are also increasing, but that does not nearly explain the more explosive increase in equity price bilateral correlations. Given the lower capital control, increased capital flows, and greater economic integration, there are structural reasons for bilateral correlation changes. However, the most important may be the tighter financial links between US monetary policy and global risk appetites across countries.

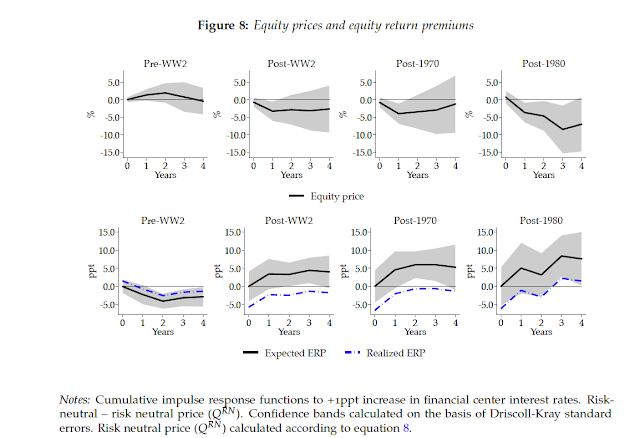

The paper “Global Financial Cycles and Risk Premiums” provides a wealth of empirical information on this critical topic. It shows an apparent change in equity premiums’ response to an interest rate shock over the last few decades.

If this work is accurate, we should see equity prices decline with the Fed’s higher rate policy. Holding risky assets abroad will not provide safety, as global risk appetites change with monetary policy tightening. Investors will have to look harder for diversification in their portfolios.

Given the lack of diversification from equity risk premiums, investors will have to look to alternative risk premiums to gain diversification based on factors less sensitive to risk appetites. This may not be easy since attitudes to risk pervade all risk premiums.