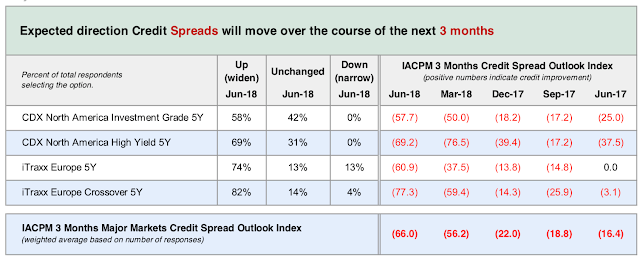

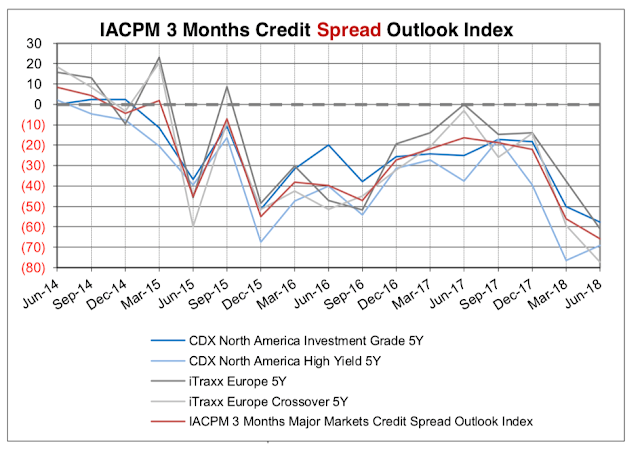

The survey from the International Association of Credit Portfolio Managers shows a significant change in the sentiment of credit managers on the direction of credit spreads. The diffusion index which ranges between 100 and -100 shows that the increase in negative sentiment has moved significantly downward. This decline is occurring even with corporate and high yield indices showing some tightening this last month. The survey was conducted in June, but the tilt is strong. This bias should be included in any portfolio adjustments.

Think about credit risk premiums relative to other risk premium alternatives. If investors would like to acquire excess returns, they should be generated through investments in other risk premium that are not showing the same negative tilt.