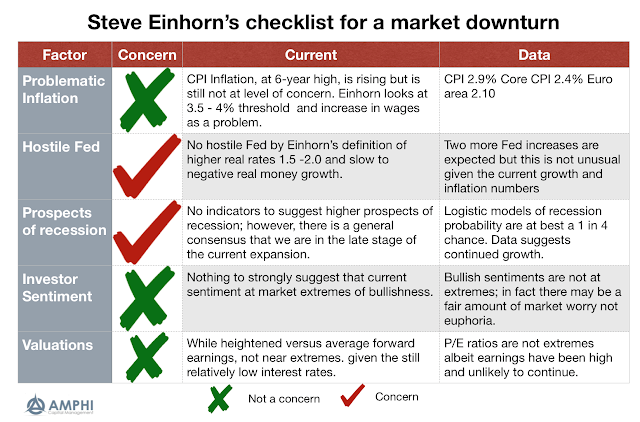

Recent interviews with Steve Einhorn, the long-time hedge fund manager, provide his checklist for when a bull market may turn into a bear market. It is not supposed to be a definitive forecast but a good simple indication when conditions are ripe for a change. See Boyer Blog and Barron’s.

Einhorn’s list of things to watch is not surprising, but it does provide a level of specificity often lacking from others. Market environment checklists are essential because they define terms and provide details for when financial changes may occur. There will be surprises, but a bear market checklist sets the tone for any allocation discussion. They can be quickly developed and checked regularly.

Steve Einhorn’s Checklist:

- Problematic Inflation

- Hostile Fed

- Prospects of recession

- Investor sentiment

- Valuation

Inflation is not a problem, albeit currently above the 2% target. The Fed is engaged in QT and raising rates, but their action is consistent with the currency of the US economy. We are concerned about the impact of dollar shortages on the rest of the world. The recession prospects are low, although many believe we are in the late stages of the expansion and market cycle. Investor sentiment is not extreme, although we closely watch the credit cycle. Valuations are not at extremes, but there should be concerns that forward earnings may not be able to maintain current high levels.

Checklists can come in many forms: What are current conditions, potential excesses, or risks that have not been realized? A recent market environment assessment does not appear stormy.