The single largest diversification play for investors over the last two decades has been the strong negative correlation between stock and bonds. There are portfolio managers and investment analysts who have spent their entire career under the negative stock-bond correlation advantage, yet times change. Finance’s greatest “free lunch” is not a one-sided bet. Older managers can impress young analysts even in their forties of old tales of “back in the day” when stocks and bonds moved together. Some may argue that elders who talk of this should be retired and just let the new guys run things, but investors should discuss and prepare for alternative equity/bond environments.

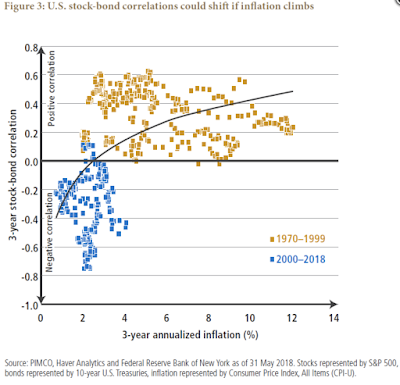

Future stock/bond correlations are closely tied with the inflation issue. Investors should expect that the same story from ancient financial history will apply if inflation averages above 4 percent. This scenario should be discussed even if investors and portfolio managers never faced sustained inflation above 4% for any part of their careers.

With inflation higher, investors should consider two major asset allocation issues:

- Measurement – What is the impact on portfolio risk if the stock/bond correlation just stays higher than the norm for the last two decades? What will happen to my portfolio’s volatility if the stock/bond correlation just turns positive?

- Action – What should an investor do to adapt to any changes in the stock/bond correlation? Where should diversification come from in the future?

Increases in correlation between major asset classes will lead to higher portfolio risks. Even if asset class volatility stays the same, higher correlation will have a real portfolio effect and change any portfolio hedges. Taking no portfolio action will cause portfolio volatility to rise.

A core action is to find new diversifiers, but that should require thinking about the cause of the low stock/bond correlation in the first place. Research shows that inflation is a key driver of the stock/bond correlation although one is a supposed to be a real asset and the other a nominal asset. Nonetheless, the search should be on for higher performing positive inflation beta investments. Investments that truly have the ability to increase earnings or cash flow with inflation should be on the top of the list. Any asset that is negative correlated with bonds will offer some inflation hedge for fixed income. Finally, switches away from assets that have positive stock or bond betas should be added to the portfolio.

Of course, discussing correlation masks the key issue relationships across assets are tied to return behavior. Higher inflation requires a turn to real assets. Still, a higher inflation environment is not a guarantee, so the safest bet is just finding lower correlated assets and strategies to traditional stocks and bonds. Making this new choice conditional on some minimum absolute or relative returns and the choices become fairly limited. The search should on, but the number of viable choices is limited.