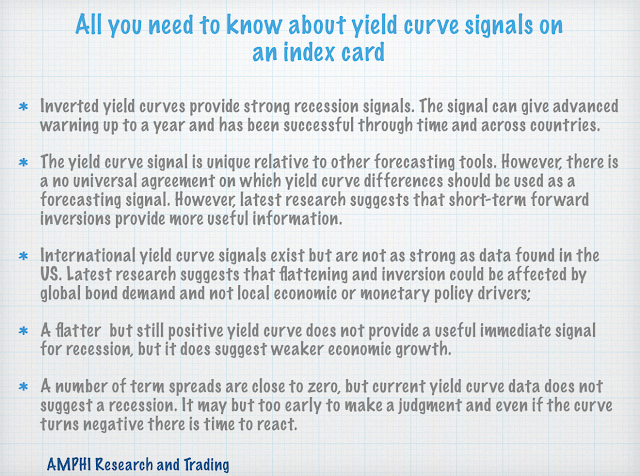

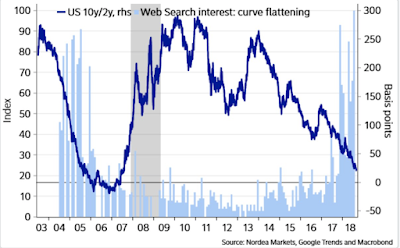

There has been a growing focus on the yield curve and the threat of recession. If you don’t believe me, look at the number of web searches. The interest is high, but all that you need to know can be placed on a 3×5 card. Investor interest in the shape of the yield curve should be high, but that does not mean a recession is around the corner.

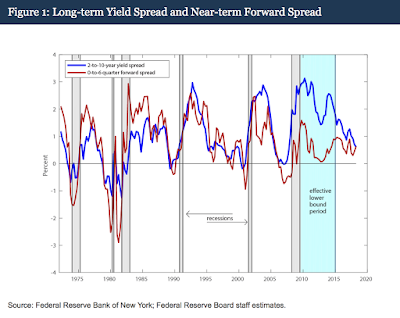

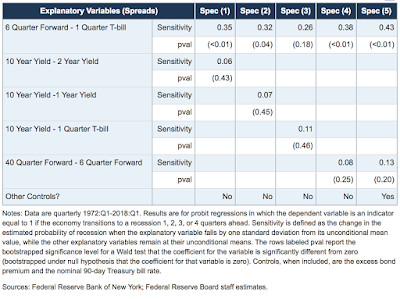

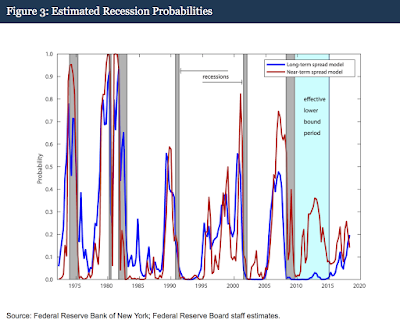

There are a number of measure to look at the yield curve signal, so it is important not to be focused on any single curve number; nevertheless, recent work from the Fed suggests that short-term signals may be better than long-term signals. See Fed Notes, (Don’t Fear) The Yield Curve which may be the most current thinking at the Fed. Eric Engstrom and Steven Sharpe find that a short-term forward spread signal does better than a long-term measure like the 2-10-year Treasury spread. The short-term forward spread has better explanatory power.

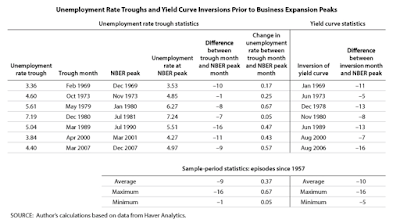

Investors should not forget other measures like unemployment rate troughs which can also be a good measure as a recession signal. Inverted yield curves add unique insight but forecasting may be improved by looking at a more holistic picture as presented in a recent St Louis Fed Research Economic Synopses: Recession Signals: The Yield Curves vs. Unemployment Rate Troughs

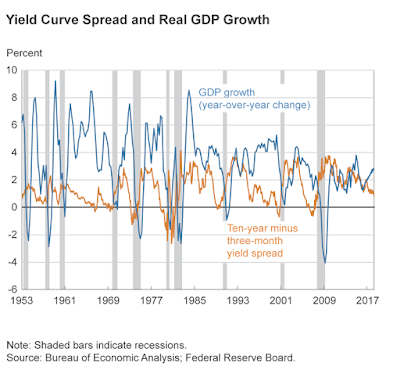

What we do know is that even if the yield curve just stays flatter and does not turn negative there will be an expected slowdown in economic growth per data from the Cleveland Fed.

An important question is for what purpose the inverted yield curve forecast is being used. Forecasting a recession is useful but a more important purpose is finding the expected behavior of financial assets. The trough in the business cycle often is a time for buying not selling financial assets. What is not as clear as the recession forecasts is the link between the yield curve and the return performance of different types of financial assets. This is perhaps the more important question, yet the flattening has not generated equity declines in the US and may have only impacted risky emerging markets.