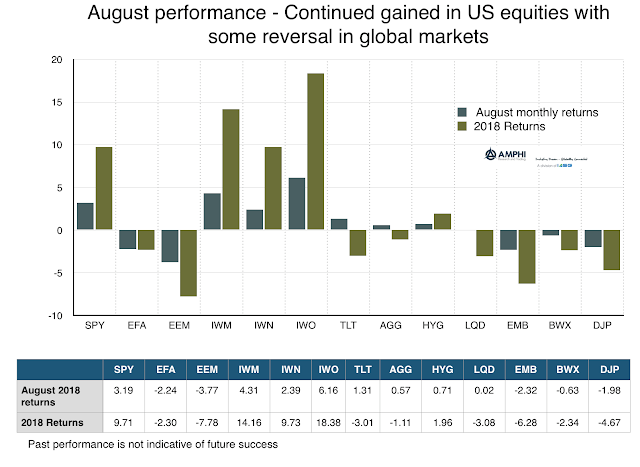

What can be called the twin disconnects of 2018 have continued this summer. There is the disconnect between market and political behavior. If you read the newspaper headlines, you would think there is government confidence crisis in the US, yet if you plot market activity, any investor would suggest the economy is in great shape. There is also the disconnect between US market activity and global market behavior. 2018 is shaping up to be a great year especially for small cap and growth benchmarks that are both up double digits with August again showing strong performance. Global and emerging markets, both equities and bonds, are sickly.

Disconnect of this magnitude do not last and as we come back from summer vacation and focus on asset allocation, the big issue is to either maintain or fade the major dislocations. Cut US stock exposure and add international equities. Cut risky equities and add to bond exposure. Unfortunately, it will take some major fortitude to make the switch against momentum, current macro data, and firm-specific strength. There is a wall of worry concerning high credit exposure and leverage, but it may still be early to make expensive allocation changes. Still, early after a great 8 months may be a safe strategy.