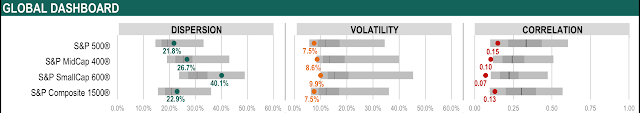

Whether, large-caps, small-caps, growth or value as measured by the major stock index benchmarks, US stocks markets are having a good year, but you would not know it if you saw August or year-to-date hedge fund style performance. Many hedge fund managers seem to have missed the big equity moves and not generated alpha. We find this especially odd since market dispersion and correlation numbers within indices show that there should have been a significant number of unique opportunities as measured by S&P Dow Jones Indices.

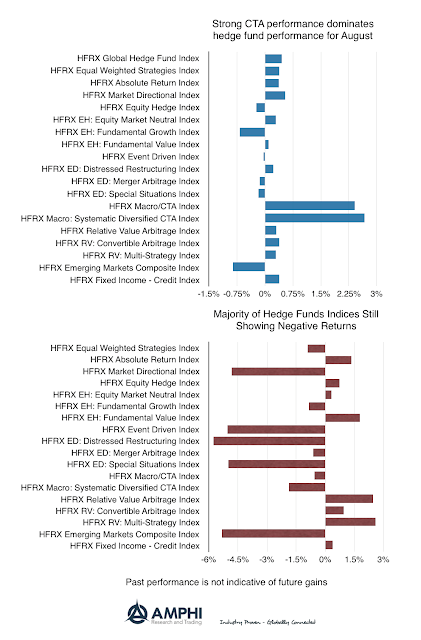

Look at August and you would have thought there was a significant market dislocation given the strong CTA performance versus other hedge fund styles. You may have thought that the defensive / crisis alpha styles were signaling a market divergence, but that was not the case last month.

For the year, 10 of 18 hedge fund styles are reporting negative benchmark performance based on the HFR indices. We accept that there can be significant dispersion around managers within a style benchmark, and that the vast majority of investors mistakenly believe that they hold managers that beat the indices averages. However, these style benchmarks tell us a lot about the state of hedge fund industry. Absolute return is an elusive goal for many managers even in a strong equity market.