Investments in alternative risk premia (ARP) are way to access the important building blocks for returns and generate return streams that will not be highly correlated with market beta exposures. Through factors and styles like value, carry, momentum, and volatility, investors can generate unique return streams relative to asset class betas. To show the value of alternative risk premia, we have taken a broad based index constructed from HFR through bank swap products and compared against a standard 60/40 stock/bond index. The HFR index is new and represents only a portion of the growing ARP market and may not include the largest banks. Still, it may provide some insight on what realistic value can be added through investing in a portfolio of risk premia.

For a simple 60/40 stock/bond blend, we combined SPY and AGG rebalanced monthly. For an alternative risk premia portfolio, we used the HFR Bank Systematic Risk Premia Multi-Asset Index, which combines risk premia in credit, rates, equities, commodities and currencies. There is a suite of HFR risk premia indices, but we employed their broad-based asset class index to show proof of concept. These risk premia indices are relatively new and we have concerns of the breath of coverage with the index, but it serves as a first pass of what is possible.

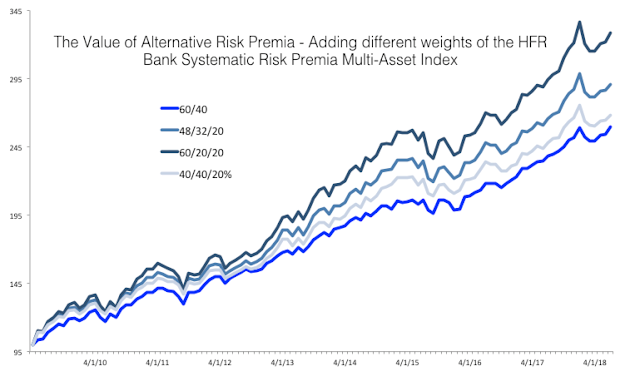

We looked at four combinations: 1. A base case 60/40 stock/bond SPY/AGG portfolio; 2. An 80 percent 60/40 proportional portfolio with 20 percent in the HFR risk premia index; 3. A conservative 40/40/20 portfolio of equities/bond/risk premia; and 4. An equity focused 60/20/20 equity/bond/risk premia portfolio. We started the portfolios in May 2009 as the beginning of the post Financial Crisis period through July 2018.

The results show that alternative risk premia at very generic level are able enhance a portfolio relative to a base 60/40 stock/bond blend. The best performer was an allocation to stock and an alternative risk premia substitute for bond exposure, followed by a proportional allocation to alternative risk premia, and then a lower allocation to stocks. The high equity exposure should not be surprising given the strong performance of stocks since 2009.

While there is no guarantee that this performance can continue in the future, it is suggestive of the gains from alternative risk premia during a period of strong equity gains and strong bond diversification benefit. The alternative risk premia basket was able to generate better returns than a bond portfolio, good diversification relative to stocks and bonds, and performance that will not generate significant return drag. This is all without any special structuring of the portfolio.