One of the core issues with alternative risk premia is not just determining whether they exist but how they will move through time. If alternative risk premia are time varying and associated with specific macro factors, it may be possible to tilt exposures based on current or future market conditions or avoid carry risk premia during those periods when expected returns will be lower.

What can we say about carry alternative risk premia returns, one of the most basic of risk premia? We don’t have significant amounts of live trading data across all asset classes from bank or money management providers, so we have to rely on evidence-based analysis. We can look at research concerning carry and make judgments on relative performance across asset classes and under different market conditions. Judgments based on academic evidence are not definitive, but they do provide a good guide on what to expect.

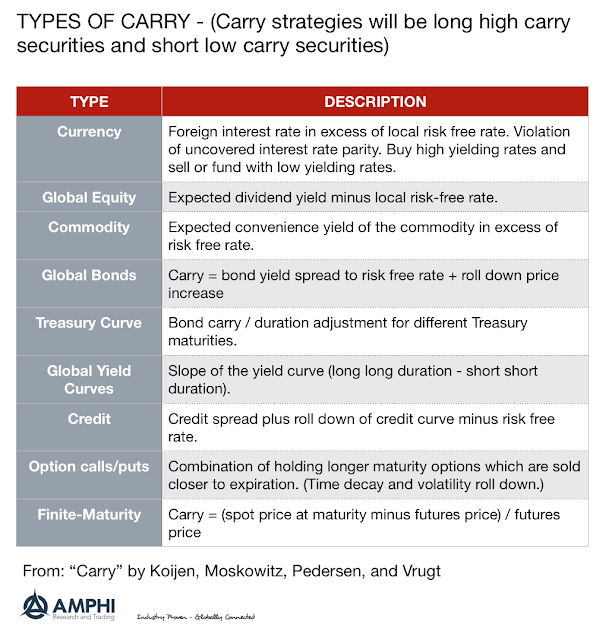

The best overview paper is this area is simple-named “Carry” by Koijen, Moskowitz, Pedersen, and Vrugt. Foremost, this paper provides a universal definition of carry and apply it across all the major asset classes. It brings together in one framework the research of many authors. As defined, carry is the stand-alone return not associated with a change in expected prices. Given this simple definition, carry strategies are just the combination of being long high carry assets and short low carry assets within an asset class. This simple definition can be applied to currencies, equities, fixed income, commodities, credit, and options.

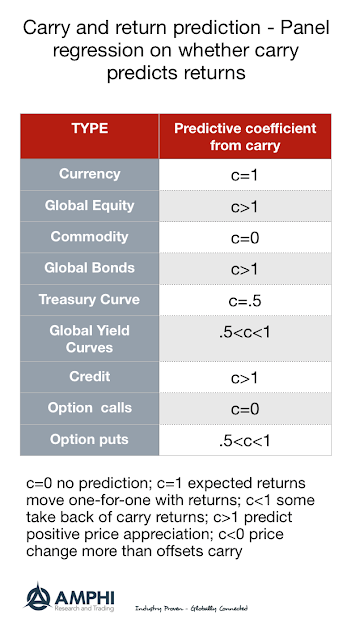

Carry can also tell us something about future returns and price changes. For example, high equity carry or dividend yield has some predictive power about the future equity prices. In other cases, future price changes will take back carry returns. In still other asset classes there is no relationship between carry and expected price changes. Our table summarizes the research in the “Carry” paper. The impact of carry on total return will vary by asset class.

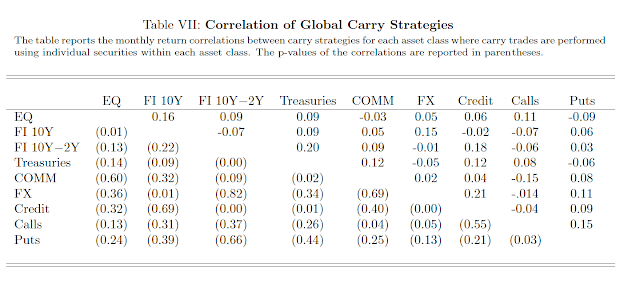

While carry is available in all major asset classes, these risk premia are not highly correlated to each other. There is benefit with building a diversified basket of carry trades.

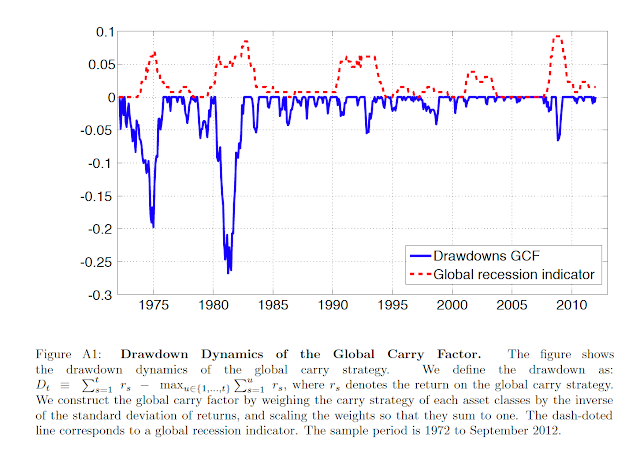

Global carry will be riskier during periods of economic stress. Using a global recession indicator, it is found that there will be greater drawdowns during recession periods. Although these drawdowns may be less than those found with market beta exposures, loses are significant. Nevertheless, all carry strategies will not behave the same during a recession. Specifically, Treasury carry will provide a defensive return stream. There is some crash risk with carry strategies but it is not universal.

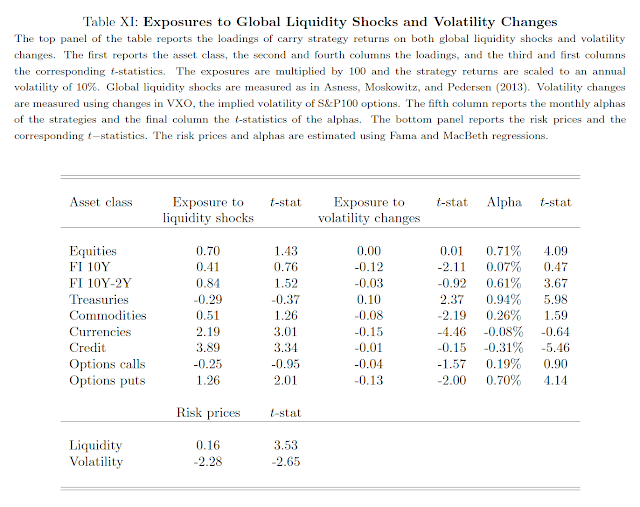

Research also finds that global carry factors will have a positive response to liquidity shocks and a negative response to volatility changes. There is still alpha during these times, but expectations for a negative liquidity shock or a positive volatility shock will have a significant negative impact on carry returns.

The evidence on carry suggests that it exists across all asset classes, but its ability to predict futures returns is highly variable. Cary returns are highly uncorrelated and can be bundled into diversified portfolios; however, carry is sensitive to recessions, liquidity shocks and volatility shocks. Overall, this well-defined macro evidence can help any investor with determining when to hold or avoid carry exposure. Carry may be good today, but a recession or volatility shock may quickly change return opportunities.