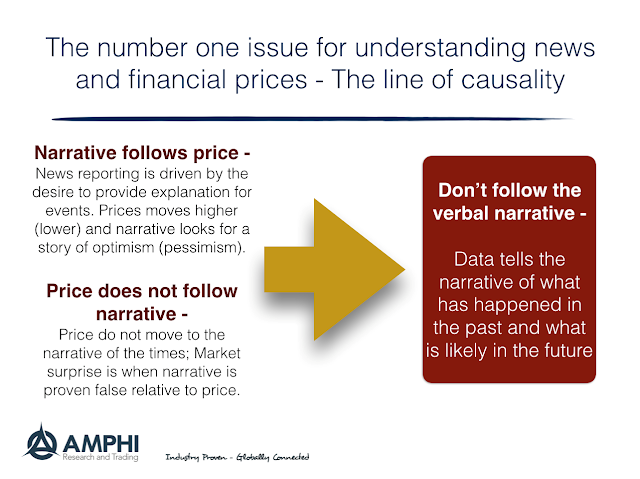

With all of the discussion on news, “fake news”, misinformation, and opinion, it is important to focus on some first principles for investing and narrative as news. The narrative is not the facts from an announcement, but the story surrounding the price move coupled with facts. For any investor, it is important to realize that narrative generally follows prices, and prices do not follow narrative.

What do we mean by this simple principle? Most writing about finance is focused on explaining the movement of price and not predicting what prices will do in the future. If prices go up, the news cycle narrative offer a story that is consistent with prices going higher. This is what reporter do. This is what analysts often do. They offer explanations for what is happening today. The news narrative of today may prove false tomorrow if prices decline. It is not a prediction and an investor who thinks of this narrative as predictive will be harmed.

A viable investment alternative is to stop reading the narrative and just follow prices. Let prices speak for themselves. This is the essence of trend-following. Prices tell the narrative without any embellishment. For the quantitative analyst, there may be the further extension to have the data tell the narrative without embellishment. The data narrative is not a story to fit the fact, but a model to suggest what will happen in the future. The data story will have underlying assumptions but it can be tested through time unlike the news narrative.

Causality moves from prices to narrative, so focusing on the basic data, using price information, and forming models will all help to not be fooled by false narratives.