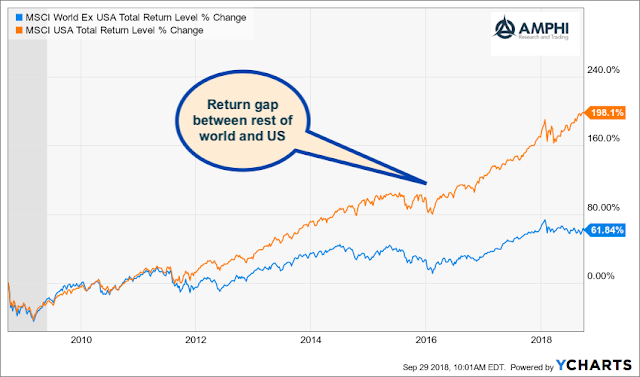

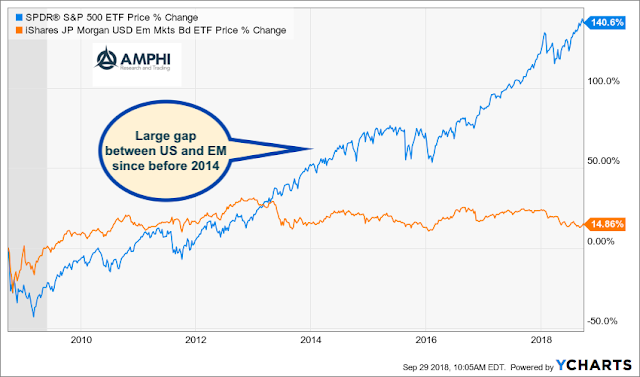

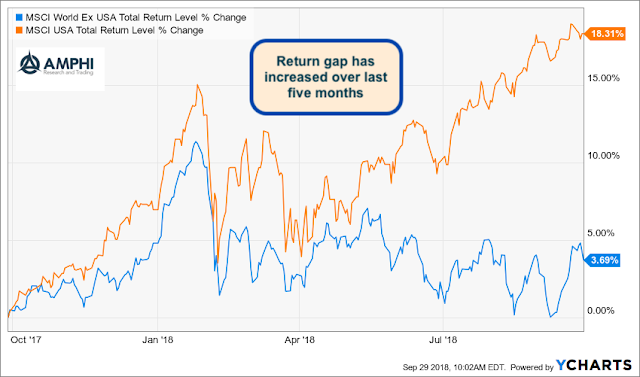

There is a large return gap in equities. The US and the rest of the world are living in two parallel equity investment universes. For the US, strong economic growth, loose monetary policy even with the current tightening, and pro-cyclical fiscal policies have proved to be a successful investment elixir. The rest of the world is facing slower growth, debt without gains, and an environment that has been filled with uncertainty. We are not arguing that the differential is unjustified. However, we are surprised by the length and size of the gap given the interconnectedness across markets especially in the developed world. This is not the equity diversification that investors expected or desired.

It was Aristotle who coined the phrase, “Nature abhors a vacuum”. An investment equivalent is that markets abhor divergences, which leads to the “Great Convergence Trade” for equities. Unfortunately, convergence often does not play-out as expected. A classic convergence will be for US equities to decline after this period of overheating and the rest of the world to gain on the switch to cheap undervalued equities. Certainly, this may be a good time to selectively increase non-US equities. Nevertheless, investor could face two declining markets under this convergence scenario. A lesser of two evils convergence does not seem like a path to riches. Without a growth catalyst for the rest of the world, we expect this gap to be maintained.