Simple assumptions to some classic monetary models will produce very different policy views for the direction of Fed action. These significant policy divergences are the reason for the recent pick-up in bond trading. A dispersion of opinions on Fed action will lead to more volatility, trading, and potential rewards in these markets.

These policy divergences even exist within the Fed. For example, a recent speech by St. Louis Fed President Bullard, “Modernizing Monetary Policy Rules”, on October 18th shows the inconsistency on what the Fed may do in 2019. These differences in “forward guidance” across Fed presidents are nothing new, but this speech shows the stark divergences in opinion using simple assumptions. When the Fed funds rate was at the zero bound, there was no confusion that rates would have to move higher. It was just a matter of timing. Now, even with Fed gradualism, it is less clear whether the current path will continue.

Bullard takes the standard Taylor Rule model, which includes the neutral rate of interest (r-star), the policy rate for inflation, an inflation gap term, and an output gap term, and changes a few assumptions to get a new recommended nominal rate of interest for Fed funds. He lowers r-star, reduces the Phillips Curve effect, and further grounds inflation expectations. Lowering r-star given long-term growth and demographics means the nominal equilibrium policy rate will be lower. Accounting for a lower Phillips curve effect makes the output gap less important. Better measures for inflation expectations suggest that these expectations are well grounded and there is less work required by the Fed to reach equilibrium policy rates.

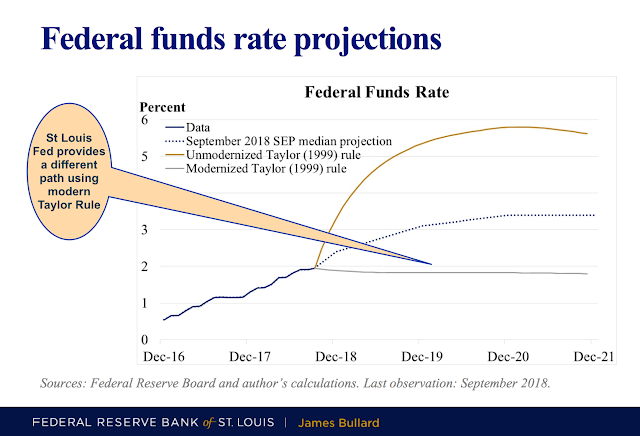

Modernizing the Taylor Rule to reflect current market behavior and thinking suggests that the Fed funds rate path should be flat. No need for further Fed tightening given current information. This is at odds with the old rule that shows a higher path and the SEP median projections, which forecast higher rates.

If the Fed follows this new Taylor Rule, it should place a hold on further increases and forward rates should come down. There should be a strong reaction away from conventional wisdom in both bond and currency markets. While the view expressed in this paper is not the consensus, the modernized Taylor Rule suggests a Fed hold could be a real possibility.