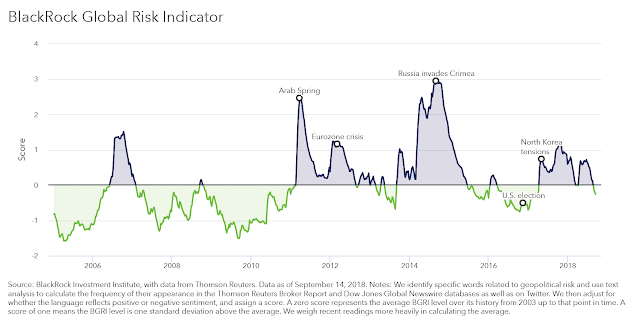

The BlackRock Global Risk Indicator is an interesting measure of uncertainty through looking at key work searches across a broad number of market news sources. I cannot say that this is a risk measure. Rather, the indicator is a measure of geopolitical negative news focus. It is a sentiment indicator that may lead to risk, as measured by negative market performance.

Key words that represent geopolitical risks are chosen for measurement. These key topics that are then smoothed by a market sentiment measure which accounts for positive and negative biases to these news stories. The data is then normalized to provide a measure of positive and negative geopolitical sentiment. This risk indicator is one of growing number of measures using natural language processing to find trends in news. The use of key word counts from news and social media is innovative and quantitative, and it provides some form of precision to the inexact measure of market sentiment to news. Opinions and views are turned into quantitative measures.

Whether it is useful at forecasting the direction of markets is suspect. A number of geopolitical events are measured, but the appropriate weight given each topic is hard to define. My suspicions are that the forecasting quality of this index is mixed. It is not because I don’t believe that this can be done, rather I have not seen the evidence. Any quantitative analyst would like “hard” analysis to support data. This indicator is better than polling, but it is not clear there is a causal link between highlighted news as measured, focus on geopolitical topics, and market activity.

The latest data shows a very benign or neutral environment for the market. If there a cause for the current market decline, it is not coming from geopolitical risks.