“Categorization is not a matter to be taken lightly. There is nothing more basic than categorization to our thought, perception, action, and speech. Every time we see something as a kind of thing… we are categorizing.”

– Linguist George Lakoff

From The Geometry of Wealth by Brian Portnoy

Most investment work is about forming categories. We divide securities into asset classes. We make subcategories within an asset classes. We make industry classifications. We divide risks into different types of premia. There are value classifications. There are categories and classifications based on macro factors like inflation. Investors like to group. All scientists like to make groups and form clusters of similar things to find commonality.

The basics of science have always been about categorization. Whether animals, plants, or rocks, the basic work of observation and classification has been a core principle of observational science. Before there is theory, there is observation and the observation lends itself to systems of classification. Before we can offer explanation, there is a need for categorization and search for sameness and differences. Providing taxonomies helps us understand the world around us.

Categorization is part of the narrative of science and a normal part of the storytelling of finance. The categorization is a heuristic for finding or describing correlation and similarity. The theory of finance attempts to look beyond classifications or categorization and in order to find first principles of what is an asset separate from any naming convention.

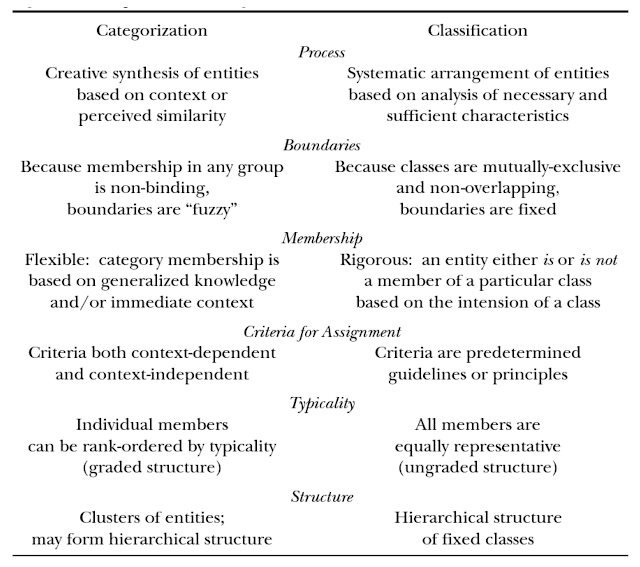

There can be a distinction between categorization and classification because most things do not fit into simple boxes. Classification is more formal and systematic based on rules. Categorization uses boundaries for similarities. See Elin K Jacob “Classification and Categorization: A Difference That Makes A Difference”. The structure of categories and classification are not often discussed and just assumed, yet the choices are important.

By grouping stuff, we can find commonality and outliers that may suggest opportunity. The convention of what is a stock or bond or the distinction of what is an industry matters. The classification of an asset, which at times is seemingly arbitrary, has structural implications. Whether rated investment grade or high yield or whether included in an index or excluded, the category placement will have real return impact. How a manager is classified by the Morningstar service, or even how a hedge fund identifies itself matters for relative performance.

So when building a portfolio and discussing allocation decisions across asset class, managers or risk premia styles, think about the implication of your categorization. The breakdown of asset classes or subclasses will impact investment decisions and return.