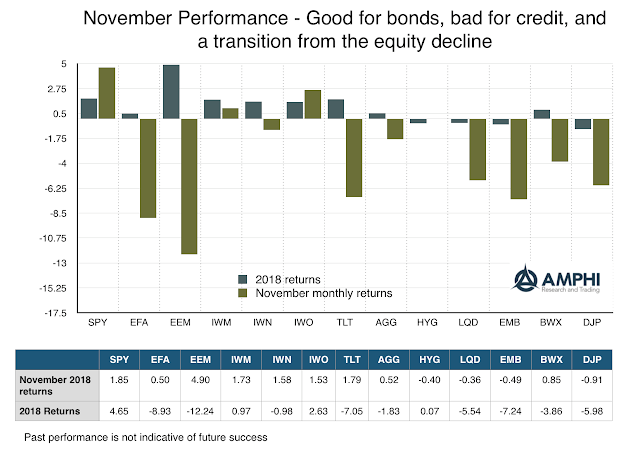

Last month nothing worked with all asset classes generating negative returns. October saw a shift in market sentiment toward risk-off behavior. Investors started to take loses and adjust to more defensive portfolios. Momentum was clearly negative early in November, but monthly returns are sending different signals with both US and global equities higher. Nevertheless, it is too early to make any statement that risk-taking is back on. Equity markets have come off lows but are not showing any trends. Credit ETFs declined sharply relative to Treasuries and long duration bonds gained on new fears of economic slowdown. Commodities declined on a sharp fall in energy prices.

Our measures of risk appetite show we are in a period of transition and not a true risk-off environment. Economic fundamental data show some growth weakness after three strong quarters, but there is limited evidence for a bear market. Recession probabilities are still low. Risk-taking in EM has shown to be profitable. The market correction may have been overdone, but a more defensive focus is still warranted given the mixed environment.