Past Performance not indicative of future results.

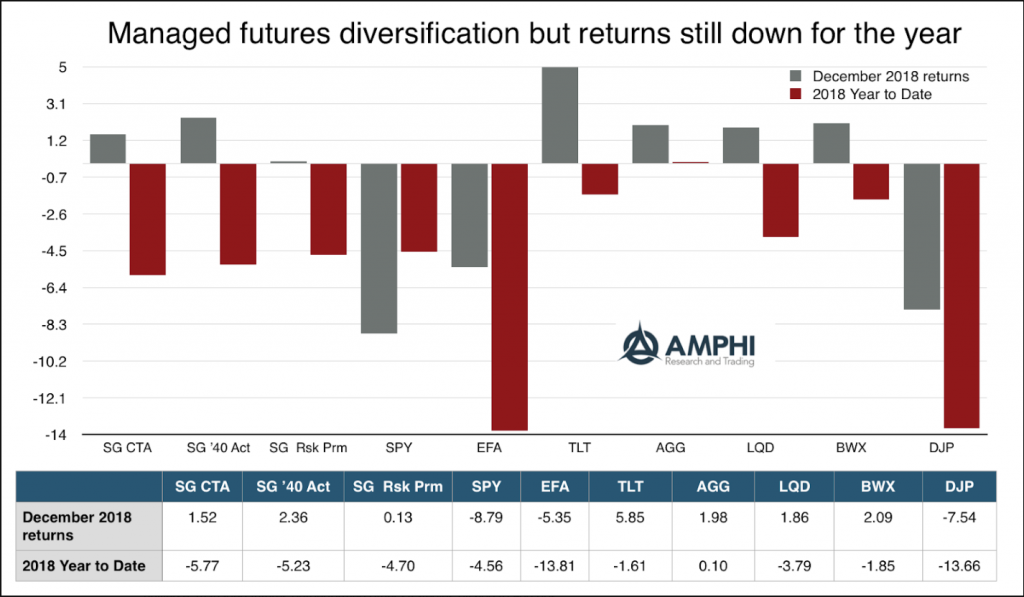

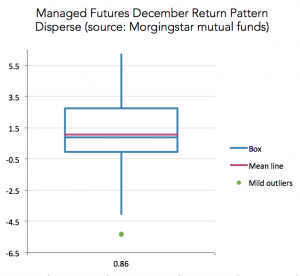

With strong trends in both bonds and equities, managed futures generated good positive returns for December. The index average does not do justice to the positive performance for some managers. For example, the CS Managed Futures Liquid Index was up around 6% for the month or four times greater than the SocGen CTA index. All of the CTA indices from BarclayHedge reported gains except for Agricultural traders. Managed futures also did well versus other hedge fund strategies and proved to be uncorrelated during the December market disruption. Versus other hedge fund strategies within the Credit Suisse liquid beta universe, managed futures outperformed other strategies by 600 to 900 bps.

Managed futures funds were able to take advantage of the dislocations in markets from both the long and short-side and were able to effectively position portfolios with the current longer-term trends. Short-term traders showed more mixed performance given the strong intraday ranges seen in markets, but again there was a wide range of winners and losers. The only reason why returns were not larger was because many managers volatility target positions and portfolios. Risk exposures were down in December.

Managed futures funds were able to take advantage of the dislocations in markets from both the long and short-side and were able to effectively position portfolios with the current longer-term trends. Short-term traders showed more mixed performance given the strong intraday ranges seen in markets, but again there was a wide range of winners and losers. The only reason why returns were not larger was because many managers volatility target positions and portfolios. Risk exposures were down in December.

While one month does not make a year, the good performance during a volatile market period may give investor pause about allocating away from managed futures in 2019.