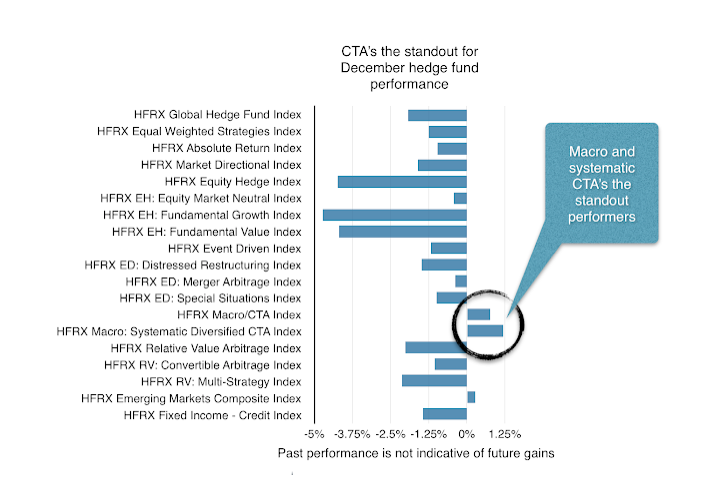

The only hedge fund sectors that made significant returns in December were global macro and systematic CTAs. These are the divergence strategies that are supposed to generate returns when there are market dislocations. Macro and systematic managers, through casting a wide net across asset classes and going both long and short, should find opportunities when there are significant dislocations. The remaining hedge fund strategies lost money, but significantly less than the exposure to market beta. It was not a successful month for most hedge funds, but it was not as bad as exposure to equity beta. However, long duration Treasuries proved to be a better hedge.

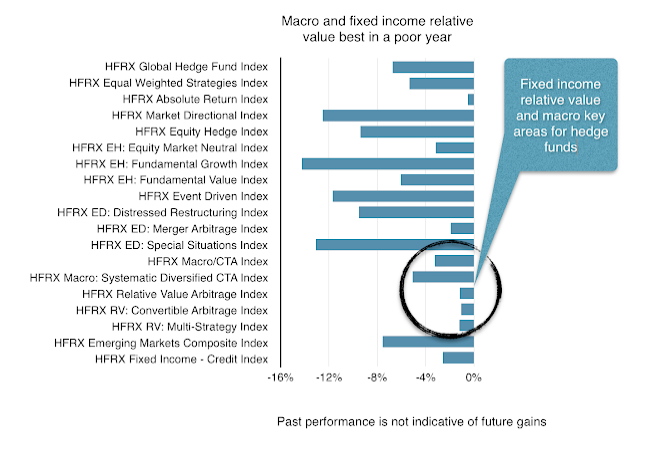

For the year, many hedge fund strategies actually underperformed equity and fixed income beta benchmarks. The only areas that performed well on a relative basis were fixed income relative value and CTA (global macro and systematic) strategies. Of course, these are index averages, but it provides some insight on hedge fund behavior during a difficult year.