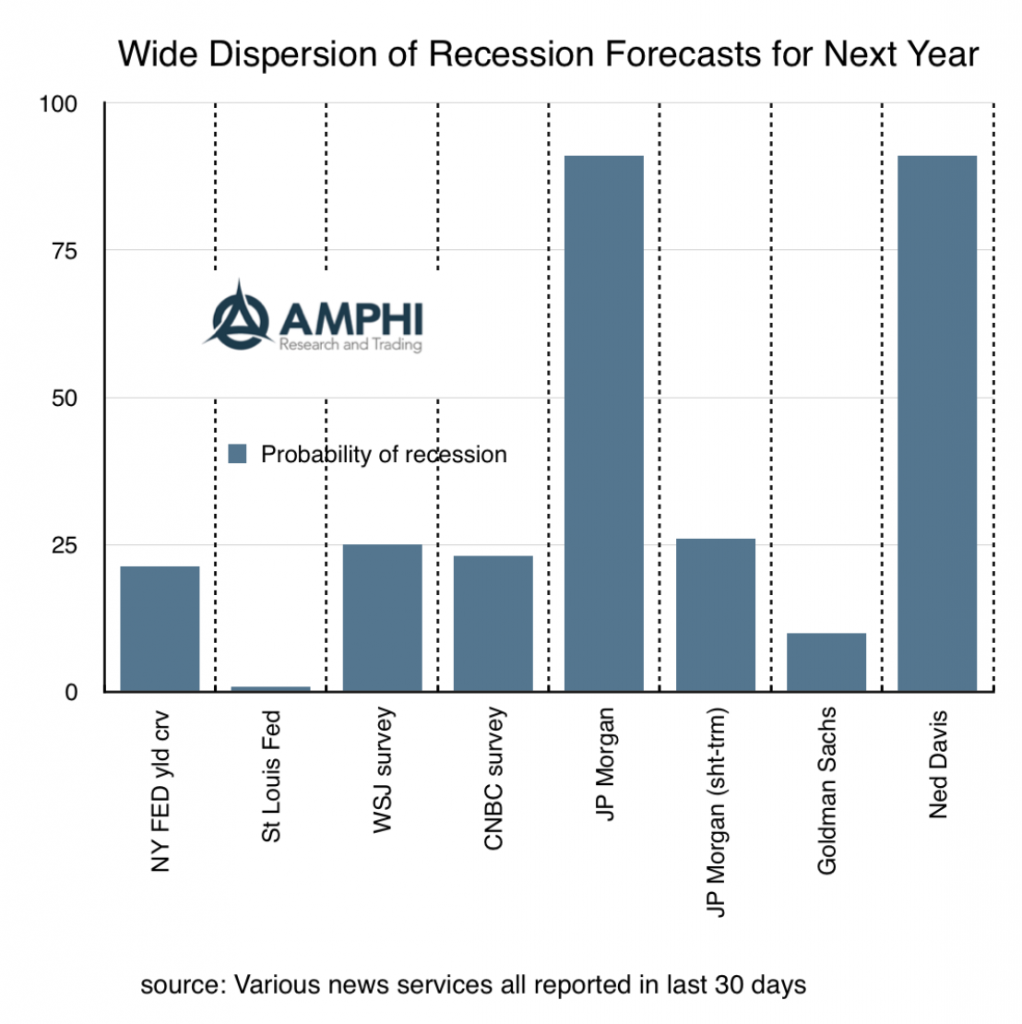

What is the chance of a recession this year? Many have tried to build systematic models to give a probability number. This has been a good advancement in thinking about macro forecasting, but the variability of forecast is unusually wide. Different inputs will give different probabilities and there is no consensus on what should be the right inputs.

Currently, there are systematic models that estimate the probability as being less than 1 percent as well as models that say the likelihood is 90 percent. There is also survey work that measures the median view of a recession. There is no doubt the chance of a recession is higher today than a year ago but a median of all the forecasts is around 25 percent. This is not high enough to cause a fully defensive cash rich portfolio to be implemented. However, the upward trend in expectations is signal enough for investors to reduce risk.

Continued increases in probability should, in general, lead to further reduction in risk exposure, but the high dispersion means there is a greater opportunity for higher returns based on swings in market judgment.