There has been increased market talk about the next recession. Many predict it will occur this year, albeit the dispersion of views is wide. To properly assess the cause of the next recession, investors should go back to the causes of past recessions. This one will be different, but we should assume there will be common features with the past.

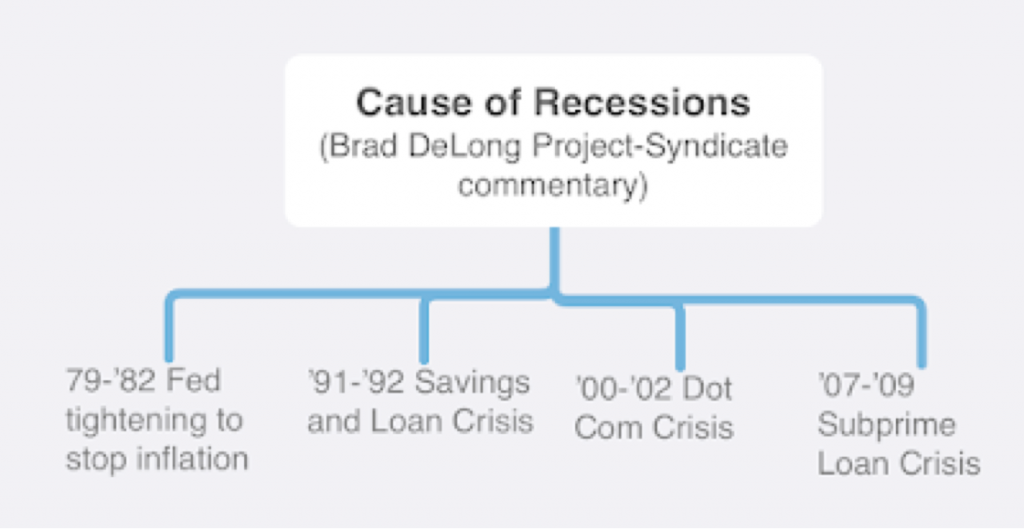

Brad DeLong provides a historical view in a recent Project-Syndicate commentary. While his work is not definitive, it focuses on a critical point: the last three recessions were all related to a financial crisis or dislocation. There may be many causes for these financial crises, but there still is the commonality that financial excesses have been the driver.

Working from this premise, it is likely that the next recession will also be crisis-driven. Consequently, we need to focus on what will be the financial crisis catalyst that will potentially drive the US economy into recession. Any crisis will likely be linked to an inadequate policy response caused by the uncertainty associated with the crisis events and the cautious nature of policy-makers. Policy missteps will exacerbate any crisis, and the potential for mistakes is higher under current policy management.

Given the first cause will still be a financial dislocation, our sleuthing will have to focus on where this financial crisis will occur. The global financial system is highly levered based on the extended period of low-interest rates. Many governments continue to run high deficits with little room for counter-cyclical policy. Corporates are highly levered with increased risk in the triple BBB corporate bond market. Consumers’ leverage is a mixed bag, but student loans have exploded in the last decade. The recent market downturn has negatively affected European and US banks, and there is heightened stress in Chinese financial markets. A susceptible area is the dollar-denominated debt with emerging markets.

While many credit sectors are at heightened risk exposure, there is no single market sector that is extremely stretched. There is no tech bubble. There is no mortgage bubble, even with housing prices at highs in some markets. There is no special stress in key financial sectors. The heightened risk from high leverage will make any economic shock more meaningful. The potential for a financial crisis is everywhere and nowhere, and that overall leverage risk may be the potential flashpoint, but it may not be immediate.